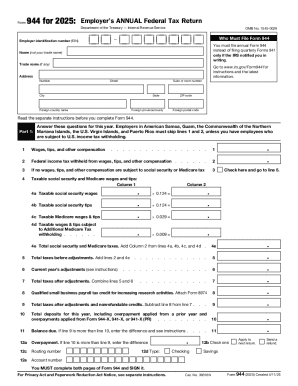

IRS 944 2016 free printable template

Instructions and Help about IRS 944

How to edit IRS 944

How to fill out IRS 944

About IRS previous version

What is IRS 944?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 944

How can I correct mistakes after filing form 944 for 2016?

To correct mistakes on form 944 for 2016, you need to file an amended return using the appropriate procedures outlined by the IRS. Ensure that all corrections are clearly indicated and include any necessary attachments to support the changes. Filing an amendment promptly is crucial to avoid penalties and ensure accurate records.

What steps should I take if my e-filed form 944 for 2016 is rejected?

If your e-filed form 944 for 2016 is rejected, carefully review the rejection code provided in the notification. Common issues include incorrect taxpayer identification numbers or formatting errors. After addressing the specific reasons for rejection, resubmit the corrected form to the IRS as soon as possible to ensure compliance.

What is the retention period for records related to form 944 for 2016?

Typically, the IRS recommends retaining records related to form 944 for 2016 for at least four years after the date you file the return, or the date it was due, whichever is later. This retention period helps ensure that you have adequate documentation in case of audits or inquiries by the IRS.

Can I use an e-signature when filing form 944 for 2016?

Yes, the IRS allows the use of e-signatures when filing form 944 for 2016 electronically. However, it is important to ensure that your e-signature meets the IRS's requirements for authenticity and security. Check the latest guidelines to confirm compliance before submission.

What should I do if I receive a notice related to my form 944 for 2016?

If you receive a notice from the IRS regarding your form 944 for 2016, read the notice carefully to understand the issue. Gather the necessary documentation and respond promptly to address any questions or required actions outlined in the notice to avoid further complications.

See what our users say