Example Of Form 8283 Filled Out - Page 2

What is an example of form 8283 filled out?

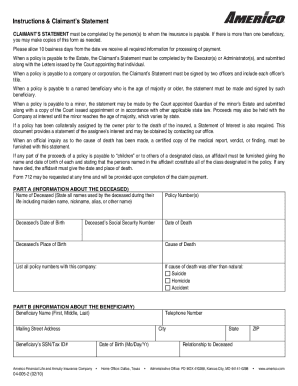

An example of form 8283 filled out is a completed document that provides information about noncash charitable contributions. It includes details about the donor, the recipient organization, and the donated property. The form also requires a description of the property, its fair market value, and the method used to determine the value. Additionally, it includes a signed acknowledgment from the recipient organization verifying the donation. This example form serves as a guide for individuals to understand how to properly fill out form 8283.

What are the types of examples of form 8283 filled out?

There are several types of examples of form 8283 filled out, including:

How to complete an example of form 8283 filled out

Completing an example of form 8283 filled out involves the following steps:

By utilizing pdfFiller, users can easily create, edit, and share their completed form 8283 online. With limitless fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor for all document needs.