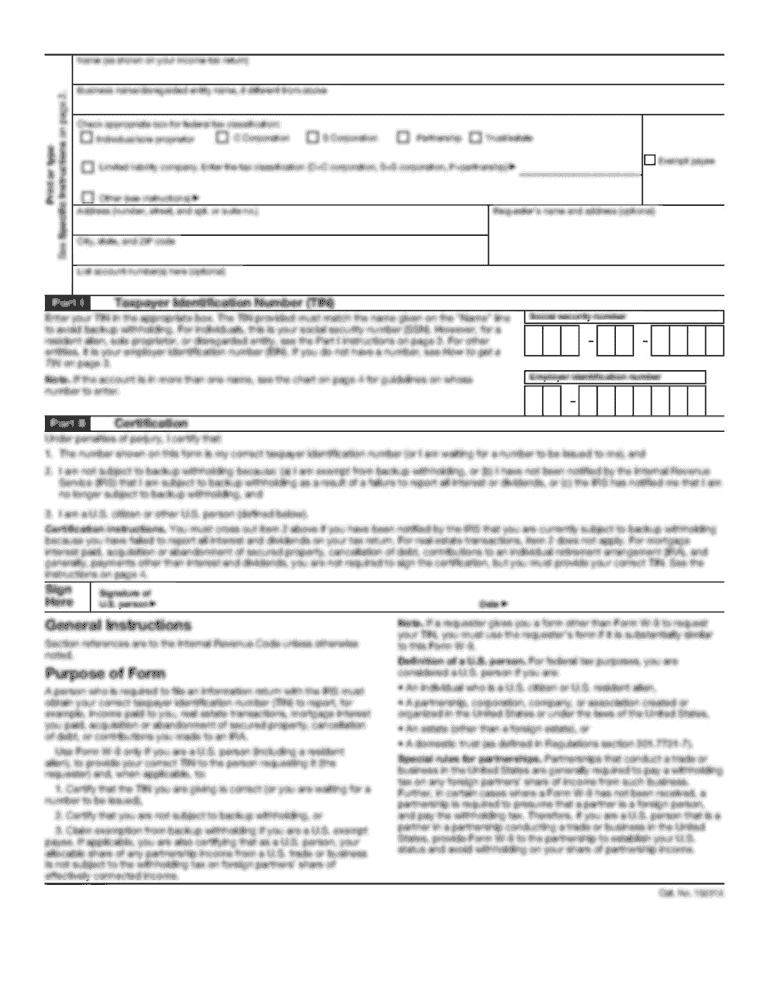

What is Excel Check Register?

Excel Check Register is a spreadsheet tool used for keeping track of financial transactions made through checks. It provides a convenient way to record check details such as check number, date, payee, amount, and memo. By maintaining an Excel Check Register, users can easily monitor their check transactions, balance their accounts, and keep their financial records organized.

What are the types of Excel Check Register?

There are various types of Excel Check Registers available to meet different user preferences and requirements. Some common types include:

Simple Excel Check Register: This is a basic template with columns to enter check details and calculate running balances.

Advanced Excel Check Register: This template offers additional features such as automatic reconciliation, category tracking, and customized reports.

Digital Excel Check Register: This type allows users to input check details directly from their bank statements and automatically updates the register.

Mobile Excel Check Register: These registers are specifically designed for mobile devices, allowing users to manage their check transactions on the go.

Personalized Excel Check Register: Users can customize this template to suit their specific needs, adding or removing columns as desired.

How to complete Excel Check Register

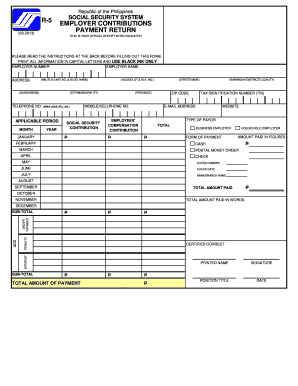

Completing an Excel Check Register is a straightforward process. Here are the steps to follow:

01

Open your Excel Check Register template or create a new one.

02

Enter the check details, including the check number, date, payee, amount, and any additional information.

03

Calculate the running balance for each transaction using formulas or built-in functions, if the template does not provide the functionality automatically.

04

Save your progress regularly to ensure data is not lost.

05

Review and reconcile your check register with your bank statements periodically to ensure accuracy.

06

Update the check register whenever new checks are issued, received, or cleared.

07

Maintain a backup of your check register to safeguard against data loss.

08

Regularly analyze and generate reports from the check register for financial analysis and budgeting purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.