What is Expense Form?

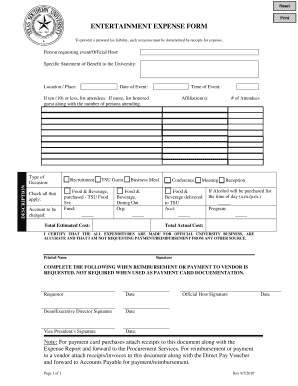

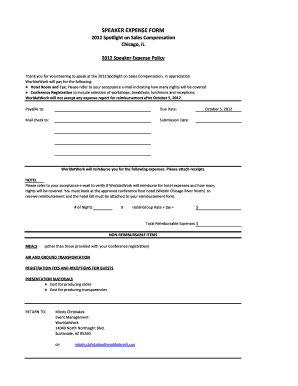

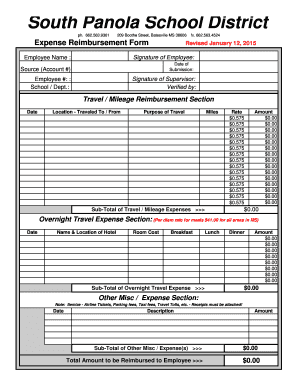

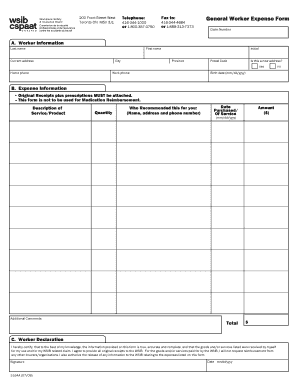

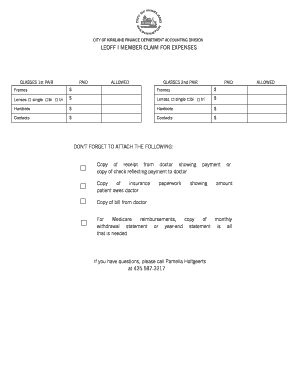

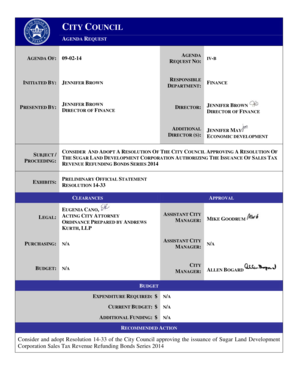

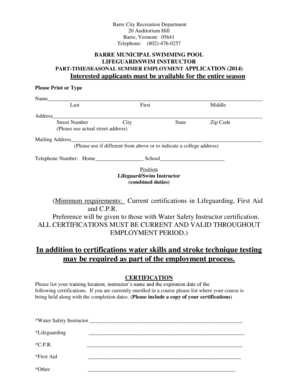

Expense Form is a document that allows individuals or organizations to record and track their expenses. It is used to keep a record of all the expenses incurred for various purposes, such as business travel, office supplies, or employee reimbursement. By using an Expense Form, users can ensure accurate documentation of expenses and facilitate the process of reimbursement or financial reporting.

What are the types of Expense Form?

Expense Forms can vary depending on the specific needs and requirements of individuals or organizations. Some common types of Expense Forms include:

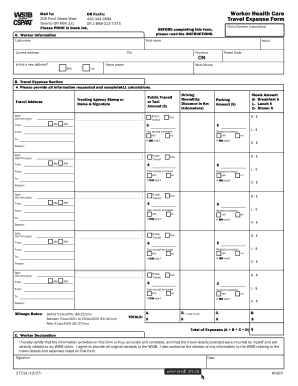

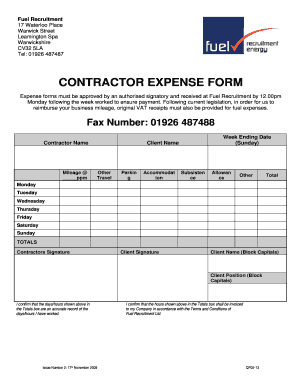

Travel Expense Form: Used to record expenses related to business trips, including transportation, accommodation, meals, and other related expenses.

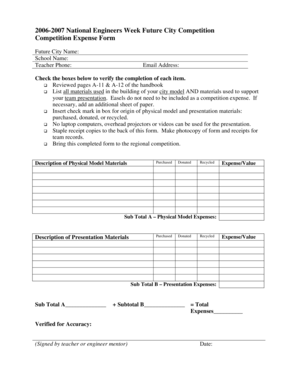

Office Expense Form: Used to track expenses associated with office supplies, equipment maintenance, utilities, or other operational costs.

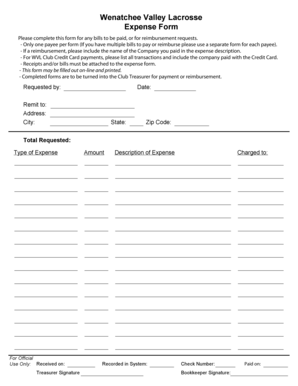

Reimbursement Expense Form: Used by employees to request reimbursement for expenses incurred while conducting company business.

Petty Cash Expense Form: Used to document small, everyday expenses paid out of a petty cash fund, such as office snacks or coffee supplies.

How to complete Expense Form

Completing an Expense Form is a straightforward process. Follow the steps below to ensure accurate and efficient completion:

01

Use a legible and clear Expense Form that includes all necessary fields, such as date, description of expense, amount, and category.

02

Fill in the required information for each expense, ensuring accuracy and completeness. Include supporting documentation, such as receipts or invoices, whenever possible.

03

Double-check all calculations and totals to avoid errors.

04

Submit the completed Expense Form to the appropriate person or department for processing and approval.

05

Keep a copy of the Expense Form for your records.

pdfFiller is a powerful online tool that empowers users to create, edit, and share Expense Forms and other documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently complete and manage your Expense Forms.