What is Expenses Claim Form?

An Expenses Claim Form is a document that allows individuals to request reimbursement for expenses incurred on behalf of a company or organization. This form typically includes fields to capture details such as the date of the expense, the nature of the expense, the amount spent, and any supporting documentation like receipts or invoices. It serves as a record of the expenses incurred and helps ensure the accuracy and transparency of reimbursement requests.

What are the types of Expenses Claim Form?

There are different types of Expenses Claim Forms available depending on the specific needs and policies of a company or organization. Some common types include:

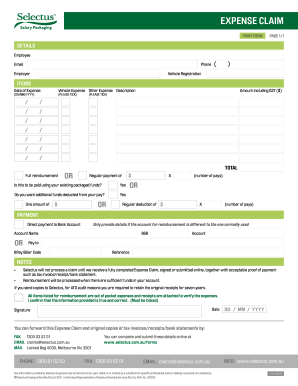

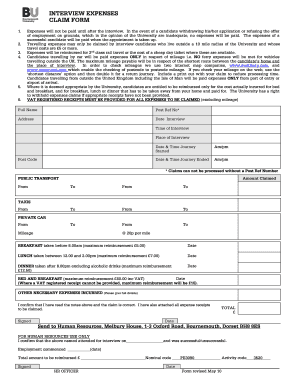

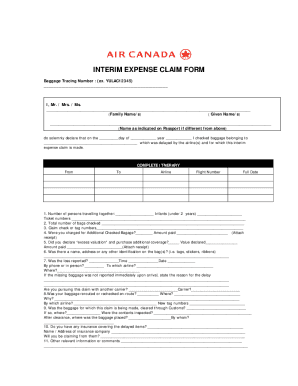

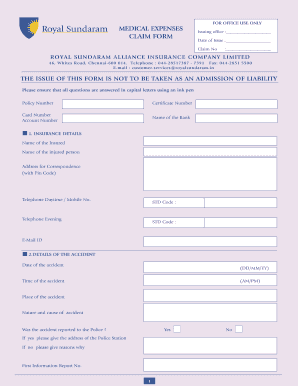

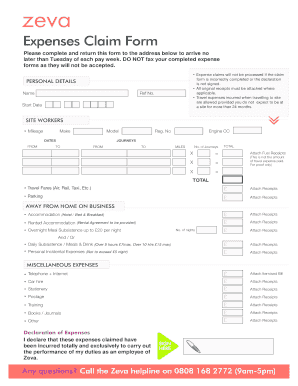

Standard Expenses Claim Form: This is the most basic form, covering general expenses such as travel, accommodation, meals, and other business-related costs.

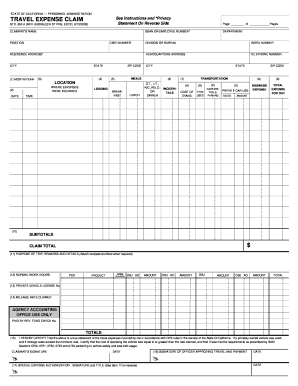

Mileage Expenses Claim Form: This form is used to request reimbursement for mileage expenses incurred while using a personal vehicle for work purposes.

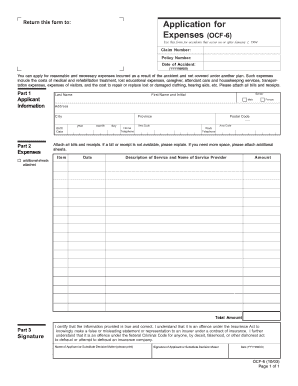

Entertainment Expenses Claim Form: This form is used for claiming expenses related to entertainment or hospitality, such as client meetings, business lunches, or events.

Project-Specific Expenses Claim Form: For companies with multiple projects or cost centers, this form allows employees to allocate their expenses to a specific project or department.

How to complete Expenses Claim Form

Completing an Expenses Claim Form is a straightforward process. Here are the steps to follow:

01

Obtain the Expenses Claim Form from your company's HR or finance department.

02

Fill in the necessary personal information such as your name, employee ID, and contact details.

03

Enter the details of each expense, including the date, description, and amount. Make sure to attach any required supporting documentation.

04

If applicable, select the appropriate expense category or project.

05

Total up the expenses and include any additional notes or comments.

06

Review the form to ensure accuracy and completeness.

07

Submit the form to the designated person or department as instructed.

08

Retain a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.