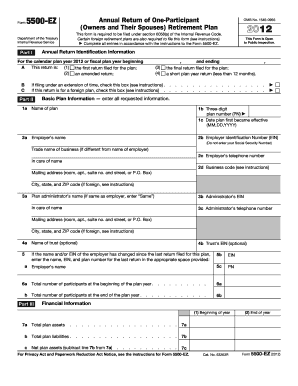

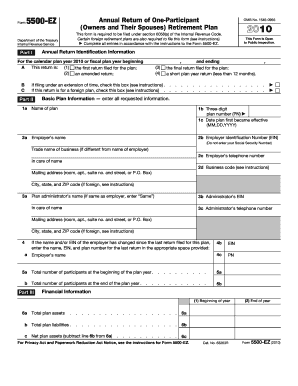

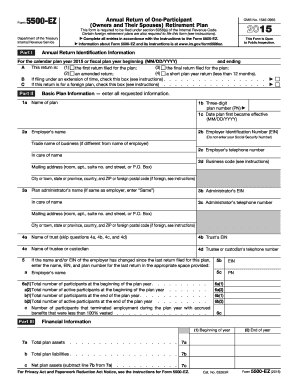

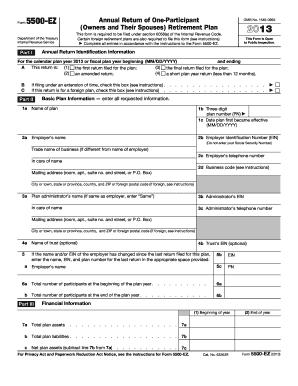

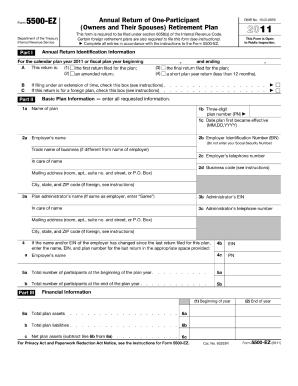

5500-EZ Form

What is 5500-EZ Form?

The 5500-EZ Form is a simplified version of the annual return/report filed by small business owners who maintain retirement plans for their employees. It is specifically designed for one-participant plans or plans with participants who are business owners and their spouses.

What are the types of 5500-EZ Form?

The types of 5500-EZ Form include:

Form 5500-EZ for One-Participant Plans:

Form 5500-SF for Small Business Owner/Spouse Plans:

How to complete 5500-EZ Form

Completing the 5500-EZ Form is a straightforward process. Here are the steps to follow:

01

Gather all required information and supporting documents.

02

Fill out the general plan information, including plan sponsors and participant counts.

03

Complete the financial information section, ensuring accuracy in reporting income, expenses, and distributions.

04

Provide the required Schedule A information, if applicable.

05

Review the completed form for any errors or omissions.

06

Sign and date the form before submitting it to the appropriate authority.

By utilizing pdfFiller, users can easily create, edit, and share their 5500-EZ Forms online. With access to unlimited fillable templates and powerful editing tools, pdfFiller becomes the go-to PDF editor for completing these forms efficiently and accurately.

Video Tutorial How to Fill Out 5500-EZ Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I fill out Form 5500?

How To Fill Out Form 5500 Enter Annual Report Information. The first step in completing IRS Form 5500 is to enter the Annual Report Identification Information necessary for Part 1. Complete Plan Information. Identify & Complete Relevant Additional Schedules. Sign and Submit Form 5500.

What is the difference between 5500-EZ and 5500-SF?

There are 3 types of Form 5500: Form 5500-EZ—for one-participant plans only. Form 5500-SF for plans with fewer than 100 participants. and Form 5500—for plans with 100 or more participants.

Do I need to file Form 5500-EZ?

Employers who sponsor one-participant plans or foreign plans must file Form 5500-EZ electronically using the Department of Labor's EFAST2 filing system. Only employers not subject to the IRS e-filing requirements under Treas. Reg. 301.6058-2 may file paper Form 5500-EZ with the IRS.

Can you efile 5500-EZ?

Beginning January 1, 2021, you can file the Form 5500-EZ electronically through EFAST2. you can no longer use the Form 5500-SF to electronically file “one-participant” plan and foreign plan annual returns. One-participant plans or foreign plans must file the Form 5500-EZ.

What is IRS form 5500-EZ?

Form 5500-EZ is used by one-participant plans that are not subject to the requirements of Internal Revenue Code section 104(a) of the Employee Retirement Income Security Act of 1974 (ERISA) and that are not eligible or choose not to file Form 5500-SF, Short Form Annual Return/Report of Small Employee Benefit Plan,

What is a 5500-EZ form?

The Internal Revenue Service (IRS) developed the Form 5500-EZ, Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan. Form 5500-EZ is used by one-participant plans and foreign plans to satisfy annual reporting requirements under the Internal Revenue Code.