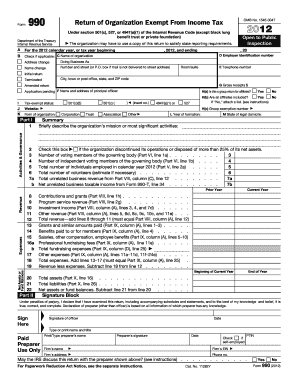

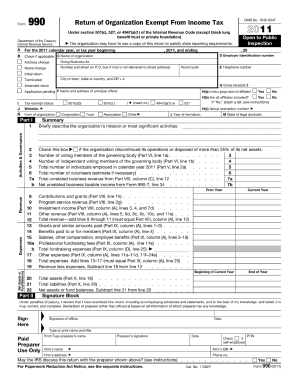

What is 990 Form?

A 990 Form, also known as an Information Return, is a document that tax-exempt organizations in the United States need to file annually with the Internal Revenue Service (IRS). It provides financial information about the organization's activities, expenditures, and any income it has received during the fiscal year. The 990 Form is an important tool for transparency and accountability, allowing the public to access information about how these organizations are operating.

What are the types of 990 Form?

There are several types of 990 Forms that organizations may be required to file, depending on their size, structure, and sources of income. The most common types include:

990-N (e-Postcard): This form is designed for small tax-exempt organizations with gross receipts of $50,000 or less per year.

990-EZ: This shorter version of the full 990 Form is available for organizations with gross receipts below $200,000 and total assets below $500,000.

The full 990 Form is required for organizations with gross receipts over $200,000 or total assets over $500,000.

990-PF: Private foundations need to file this form to provide information on their financial activities and grant distributions.

How to complete 990 Form?

Completing the 990 Form may seem daunting, but with the right guidance, it can be a manageable process. Here are some steps to help you complete the form:

01

Gather the necessary financial information: Collect all the relevant financial documents, such as income statements, balance sheets, and expense records.

02

Review the instructions: Familiarize yourself with the instructions provided by the IRS for the specific type of 990 Form you need to file.

03

Complete each section: Fill in the required information accurately and thoroughly for each section of the form, including details about the organization's mission, programs, governance, and financial operations.

04

Double-check for accuracy: Before submitting the form, carefully review all the information provided to ensure accuracy and completeness.

05

File the form: Submit the completed 990 Form to the IRS within the specified deadline, either electronically or through mail.

pdfFiller, an online document management platform, empowers users to create, edit, and share documents online, including the 990 Form. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and effectively.