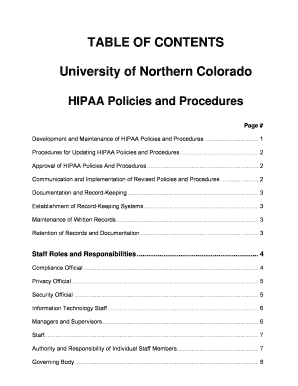

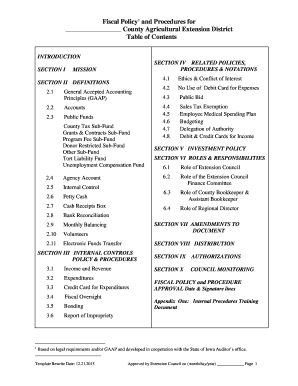

What is Fiscal Policies And Procedures?

Fiscal Policies And Procedures refer to the rules and guidelines set by an organization or government to manage their finances. These policies outline the processes and procedures for budgeting, spending, and accounting to ensure financial stability and transparency. By following fiscal policies and procedures, organizations can maintain control over their financial activities and make informed decisions to achieve their financial goals.

What are the types of Fiscal Policies And Procedures?

There are various types of Fiscal Policies And Procedures that organizations can implement based on their specific needs and objectives. Some common types include:

Budgeting policies - These policies determine how budgets are prepared, approved, and monitored.

Spending policies - These policies govern how funds are allocated, distributed, and spent.

Accounting policies - These policies define the accounting methods, principles, and standards to be followed for accurate financial reporting.

Auditing policies - These policies outline the procedures and guidelines for conducting internal or external audits to ensure compliance and identify financial discrepancies.

Reporting policies - These policies establish the requirements for financial reporting and disclosure to stakeholders and regulatory authorities.

How to complete Fiscal Policies And Procedures

Completing Fiscal Policies And Procedures involves several steps to ensure comprehensive and effective financial management. Here is a step-by-step guide to help you:

01

Assess your organization's financial needs and goals.

02

Identify the fiscal policies and procedures that are relevant to your organization.

03

Develop a comprehensive plan to implement and enforce these policies and procedures.

04

Communicate the policies and procedures to all relevant stakeholders.

05

Train and educate employees on the importance and implementation of fiscal policies and procedures.

06

Monitor and evaluate the effectiveness of the policies and procedures regularly.

07

Make necessary adjustments or updates to the policies and procedures based on feedback and changing financial circumstances.

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents seamlessly. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor that can help you streamline your document processes and enhance productivity.