Form 1023-ez

Who needs Form 1023-EZ?

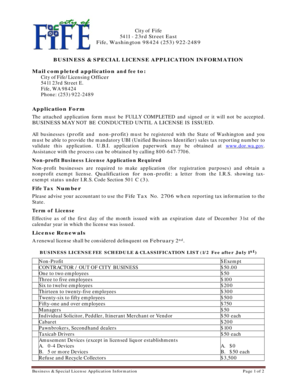

This form is called the Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. It can only be used by certain corporations. It is possible to determine if you can file it or not by checking the Eligibility Worksheet attached to the form.

What is the Purpose of the Form?

Organizations can fill out this form to request the recognition of exemption from income tax. However, there are nonprofit organizations already exempt from federal tax. They are churches, temples, synagogues and mosques or any other organizations which have a gross receipt every year of about $5,000.

When is Form 1023-EZ Due?

If an organization completes this IRS document during the period of 27 months after the month when they were officially registered, and the IRS approves it, the date of registration will be the one of the exempt status.

How to File

Generally, IRS Form 1023-EZ consists of six parts. The first part is the identification of the applicant. It includes the name, address, EIN, the month when a tax year ends, and the contacts of the organization. The second part of the application is devoted to the structure of the organization. In the third part, an applicant signifies his specific activities. The fourth part includes the information about the foundation classification. The fifth part is called the Reinstatement After Automatic Revocation and the last one requires a signature. If there are any questions, look through the instructions to IRS Form 1023-EZ.

Where do I Send it?

Submit this form to the Internal Revenue Service. Look for the address on their site. Check the sample filling to avoid mistakes and possible misunderstandings.