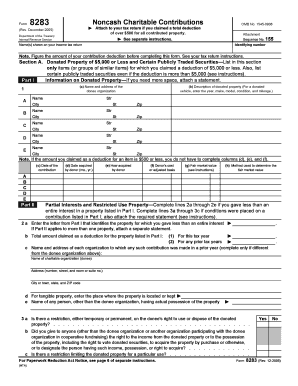

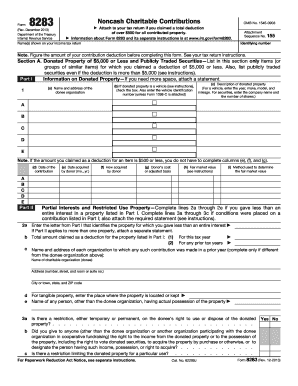

Form 8283 Instructions 2016

What is form 8283 instructions 2016?

Form 8283 instructions 2016 is a set of guidelines provided by the Internal Revenue Service (IRS) for individuals who need to report noncash charitable contributions on their tax returns. These instructions outline the specific information required to accurately complete Form 8283, which is used to report the details of donated property or items.

What are the types of form 8283 instructions 2016?

There are several types of form 8283 instructions 2016 to address different circumstances related to noncash charitable contributions. Here are some of the main categories:

How to complete form 8283 instructions 2016

Completing form 8283 instructions 2016 is a straightforward process. Here is a step-by-step guide to help you:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done more efficiently and effectively.