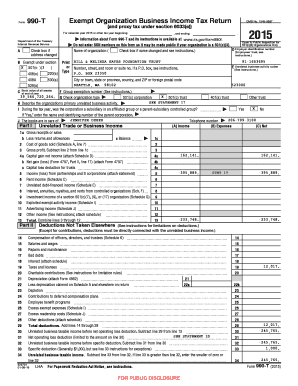

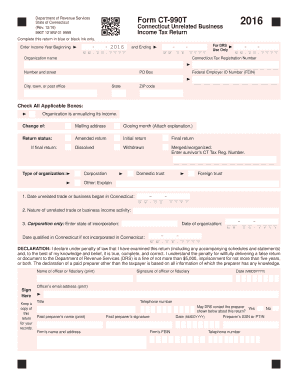

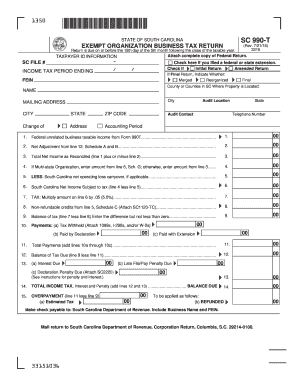

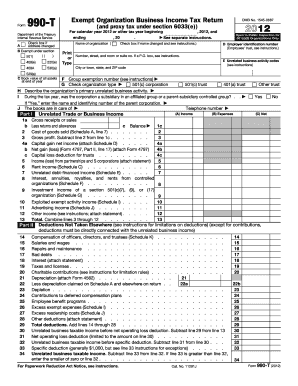

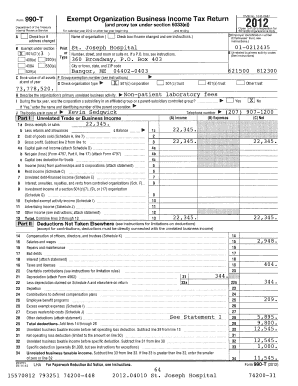

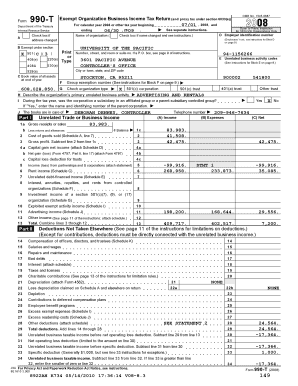

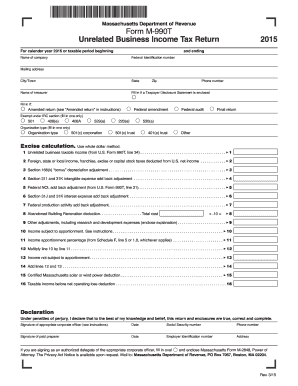

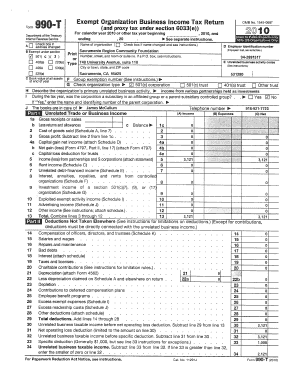

Form 990-t

What is form 990-t?

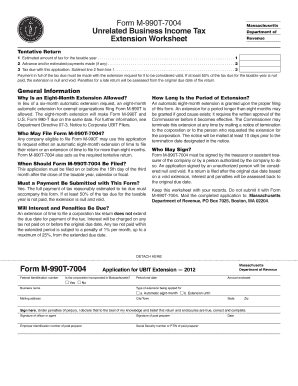

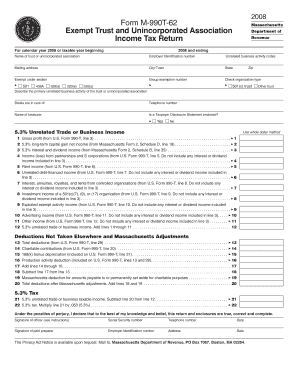

Form 990-T is a tax form used by certain tax-exempt organizations to report unrelated business income. It is filed with the Internal Revenue Service (IRS) and provides detailed information about the organization's income and expenses from activities that are not related to its tax-exempt purpose. This form helps the IRS determine whether the organization owes any tax on its unrelated business income.

What are the types of form 990-T?

There are two types of form 990-T: Form 990-T (Exempt Organization Business Income Tax Return) and Form 990-T (Corporate Adjustments). Form 990-T (Exempt Organization Business Income Tax Return) is used by tax-exempt organizations to report their unrelated business income. Form 990-T (Corporate Adjustments) is used by corporations to report adjustments to their previously filed Forms 990-T.

How to complete form 990-T

Completing form 990-T may seem daunting, but with the right guidance, it can be made easier. Here are the steps to complete form 990-T:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.