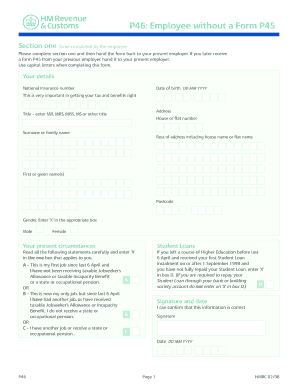

Form P45

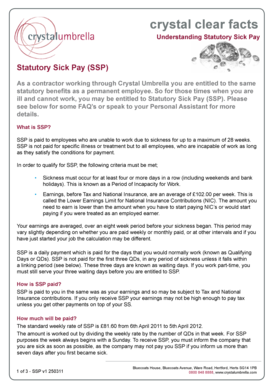

What is Form P45?

Form P45 is a document that is issued to an employee when they leave a job. It contains important information about their employment history such as their tax code, total earnings, and the amount of tax that has been deducted from their wages.

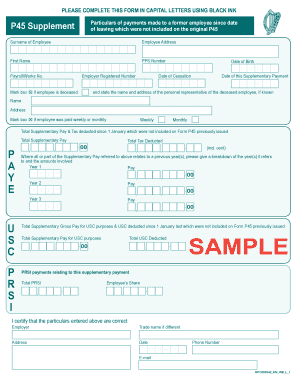

What are the types of Form P45?

There are three types of Form P45:

Part 1A: This is given to an employee who is leaving their current job and does not have a new job lined up.

Part This is given to an employee who is leaving their current job and starting a new job immediately.

Part This is given to an employee who is leaving their current job but will be receiving a pension or other benefits.

How to complete Form P45

Completing Form P45 is a simple process. Here are the steps:

01

Fill in your personal details, including your full name, address, and National Insurance number.

02

Provide information about your previous employer, such as their name, address, and contact details.

03

Fill in the date you started and left your job, as well as your total earnings and tax deducted.

04

Sign and date the form.

05

Submit the form to your new employer or to HM Revenue and Customs (HMRC) if you do not have a new job.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form P45

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you get your P45 through HMRC?

If you need more information about producing P60 or P45 forms, check your payroll software provider's website or contact them. You can use HM Revenue and Customs' ( HMRC ) Basic PAYE Tools if your payroll software cannot produce P60 or P45 forms.

How do I get my P45 from revenue online?

You will no longer receive a P45 from your employer. You can now view your pay and income tax deductions reported by your employer through the 'Manage your tax' link in myAccount. The final payroll submission will include: your pay.

How do I obtain my P45?

Getting a P45 P45 documents aren't rewarded to you as an employee, they are an official document that you have a right to receive when leaving a company. If you have lost your P45, then you can simply request a new one from your employer and they should provide it to you.

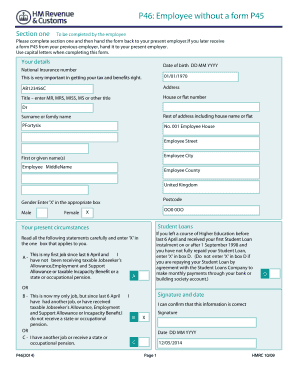

What happens if I don't have a P45?

If you don't have a P45, or fail to complete a P46, your employer will normally need to use an emergency tax code against your salary, meaning you can over pay income tax. To get help from the tax office about your P46 or P45 you can call HMRC or contact them online.

Can a P45 be issued electronically?

So – is the issue of an electronic P45 allowed? Simply the answer is yes. Would an employer want to issue electronically – that is an employer choice matter.

How can I get a copy of my P45 UK?

Lost P45. You cannot get a replacement P45. Instead, your new employer may give you a 'starter checklist' or ask you for the relevant details about your finances to send to HM Revenue and Customs ( HMRC ).

Related templates