Hardship Letter For Short Sale

What is hardship letter for short sale?

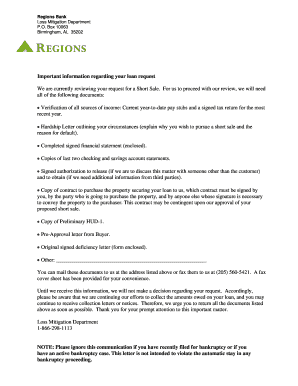

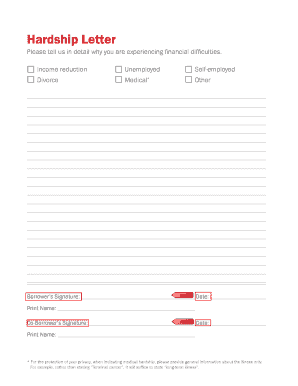

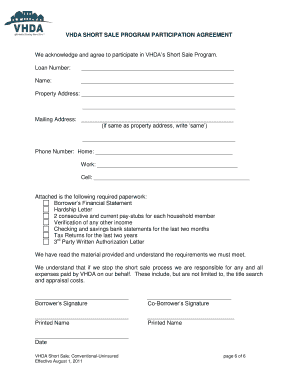

A hardship letter for short sale is a written document that explains an individual's financial difficulties and justifies the need for a short sale. It provides a detailed account of the borrower's financial situation, including reasons for their inability to make mortgage payments on time or maintain the property. The hardship letter is an essential component of the short sale process, as it helps lenders understand the borrower's circumstances and decide whether to approve the short sale.

What are the types of hardship letter for short sale?

There are several types of hardship letters that can be used for a short sale. Here are some common types: 1. Financial Hardship: This type of letter addresses the borrower's financial difficulties, such as job loss, reduced income, medical expenses, or excessive debt. 2. Relocation: This type of letter explains the need to sell the property due to a job transfer, job loss, or change in family circumstances. 3. Divorce or Separation: In case of divorce or separation, the letter highlights the financial constraints and the necessity of a short sale. 4. Military Service: This type of letter is for borrowers who are active military personnel and need to relocate due to military orders or deployment. 5. Death or Illness: This letter is used when the borrower or their family member has experienced a significant illness or death, impacting their financial stability.

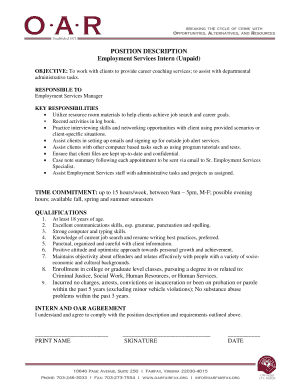

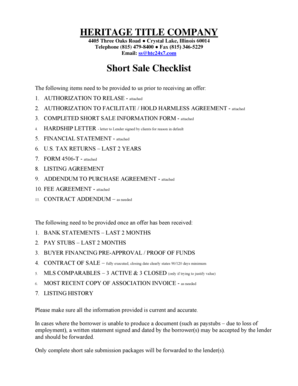

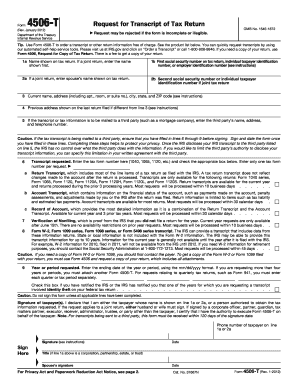

How to complete hardship letter for short sale

Completing a hardship letter for a short sale can be done by following these steps: 1. Introduction: Begin your letter with a polite and professional tone. State your name, address, and property details. 2. Explanation of Hardship: Clearly describe the financial hardship you are facing. Provide specific details and explain how it has affected your ability to make mortgage payments. 3. Supporting Documents: Attach any relevant documents that support your claims, such as pay stubs, medical bills, or termination letters. 4. Proposed Solution: Offer a proposed solution, which is the short sale. Explain why a short sale is the best option for both you and the lender. 5. Conclusion: Express gratitude for the lender's consideration and provide contact information for further communication.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.