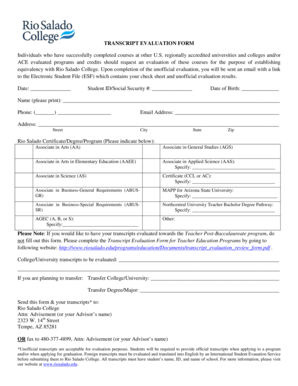

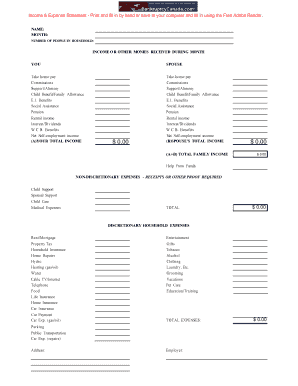

What is Household Expenses Template?

A Household Expenses Template is a pre-designed document that helps individuals or families track and manage their financial transactions related to household expenses. It serves as a convenient tool to record and categorize expenses such as rent, utilities, groceries, transportation, and more. By using a Household Expenses Template, users can gain a better understanding of their spending habits, identify areas for potential savings, and effectively budget their finances for a more organized and stress-free living.

What are the types of Household Expenses Template?

There are several types of Household Expenses Templates available to cater to different needs and preferences. Some common types include:

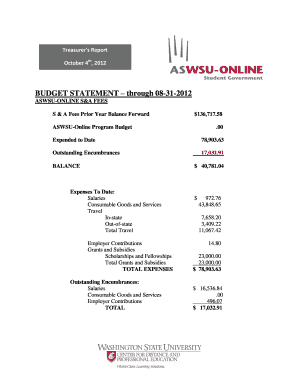

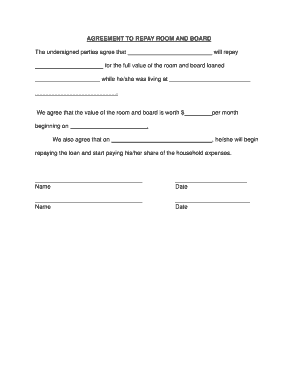

Basic Household Expenses Template: This template offers a simple layout for recording essential expenses such as rent/mortgage, utilities, groceries, transportation, and other regular payments.

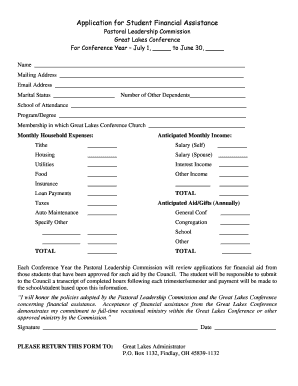

Comprehensive Household Expenses Template: This template provides a more detailed approach to managing household expenses. It includes additional categories such as entertainment, education, healthcare, and miscellaneous expenses.

Monthly Budget Household Expenses Template: This template is specifically designed to help users create a monthly budget plan and track their expenses accordingly. It incorporates features like income tracking, expense categories, and budget allocation.

Annual Household Expenses Template: This template allows users to track their expenses on an annual basis. It provides a comprehensive overview of yearly expenses and helps with long-term financial planning.

How to complete Household Expenses Template

Completing a Household Expenses Template is a straightforward process that can be done in a few simple steps. Here's how:

01

Choose the appropriate Household Expenses Template based on your needs and download it onto your device or access it online.

02

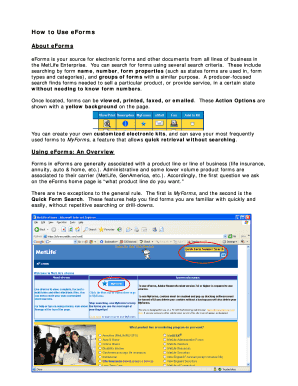

Open the template using a compatible software or online editing tool like pdfFiller.

03

Start entering your household expenses in the designated categories. Make sure to include all relevant transactions.

04

Categorize your expenses based on different expense types for better organization and analysis.

05

Regularly update the template with new expenses and review it periodically to assess your spending habits and make necessary adjustments to your budget.

06

Consider utilizing the features offered by pdfFiller, such as unlimited fillable templates and powerful editing tools, to enhance your experience with managing household expenses.

07

Save and share the completed template with other members of your household or financial advisors for collaborative budgeting and financial planning.

pdfFiller offers users the ability to create, edit, and share documents online, making it a convenient and efficient solution for managing Household Expenses Templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that caters to all your document needs.