How Does Lease With Option To Buy A House Work

What is how does lease with option to buy a house work?

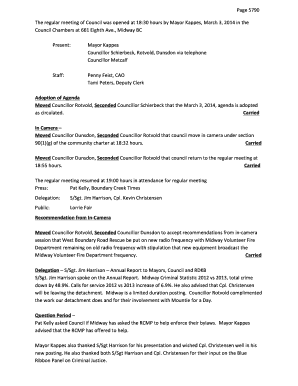

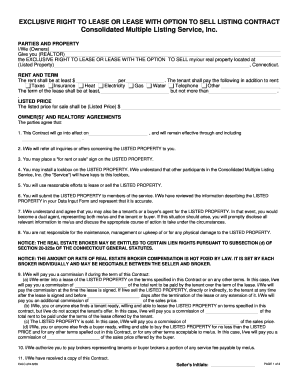

When it comes to understanding how the lease with option to buy a house works, it offers an innovative way for individuals to achieve their dreams of homeownership. Essentially, it is an agreement where individuals can lease a property with the option to buy it at a later date. This arrangement allows them to live in the house as tenants while saving up for the down payment or improving their credit scores. It provides flexibility and an opportunity for potential buyers to test out the property before committing to a purchase.

What are the types of how does lease with option to buy a house work?

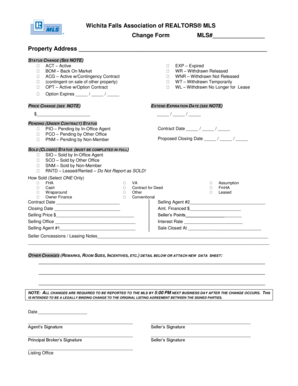

There are different types of lease with option to buy arrangements that cater to varying needs and preferences. Some common types include: 1. Lease Option: This type grants the tenant the option to buy the property at a predetermined price within a specified period. 2. Lease Purchase: With this type, the tenant commits to buying the property after the lease term ends. 3. Contract for Deed: It allows the tenant to make installment payments for the purchase of the property while occupying it. These options provide flexibility for both landlords and tenants, offering different paths towards homeownership.

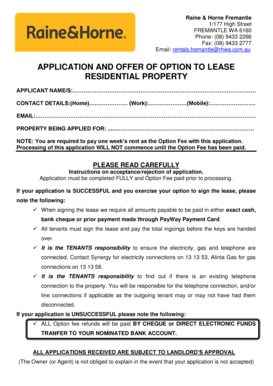

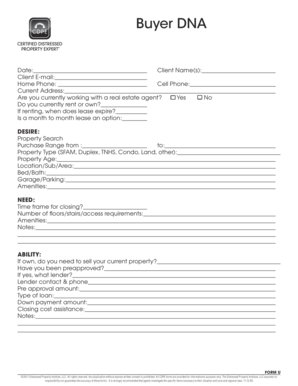

How to complete how does lease with option to buy a house work

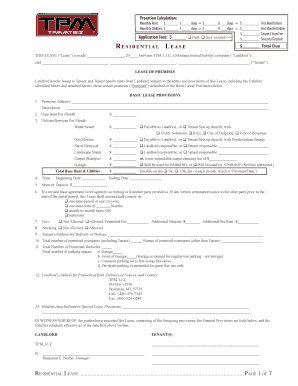

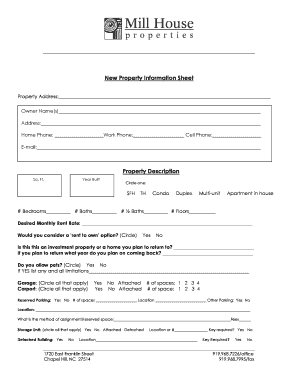

Completing the lease with option to buy a house process requires several steps: 1. Find a Property: Begin by identifying potential properties that offer lease with option to buy agreements. Research the market and consider your specific needs. 2. Negotiate Terms: Reach out to the landlord or seller and negotiate the terms of the lease agreement, including the option to buy. Ensure that everything is properly documented. 3. Review the Contract: Carefully review the lease contract, paying attention to the purchase option details, lease duration, rent payments, and any maintenance responsibilities. 4. Determine Purchase Price: Establish the purchase price or the agreed-upon method for determining it at a later stage. 5. Save for Down Payment: While leasing the property, work towards saving for the down payment or improving your credit score. 6. Exercise the Option: When you're ready to buy, exercise the option to purchase the property as specified in the agreement. Remember, it's essential to consult with professionals such as real estate agents or attorneys to ensure compliance with legal and financial aspects.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.