What is how to bill for consulting services sample?

When providing consulting services, it is crucial to have a systematic approach to billing in order to ensure accurate and fair compensation. A how to bill for consulting services sample is a template or example that outlines the different billing procedures and methods that consultants can use. It serves as a guide to help consultants understand how to bill their clients effectively and efficiently.

What are the types of how to bill for consulting services sample?

There are several types of how to bill for consulting services sample, including:

Hourly Rate: This method involves charging clients based on the number of hours worked on a specific project or task. Consultants keep a record of the time spent and calculate the total fee by multiplying the hours worked with their hourly rate.

Fixed Fee: With this type of billing, consultants charge a pre-determined fixed amount for a particular project or service. The fee remains the same regardless of the hours worked or the effort involved.

Retainer: Consultants may offer retainer billing, where clients pay a fixed amount on a recurring basis to reserve the consultant's services for a specified period. The retainer fee usually covers a set number of hours or services.

Value-Based: This billing method focuses on the value delivered by the consultant rather than the specific hours or tasks. Consultants determine the fee based on the impact and results they provide to the client's business.

Percentage of Project Cost: In some cases, consultants charge a percentage of the overall project cost as their fee. This method is common in sectors like construction or large-scale project management.

How to complete how to bill for consulting services sample

To effectively complete a how to bill for consulting services sample, follow these steps:

01

Understand the scope of the consulting project and determine the appropriate billing method.

02

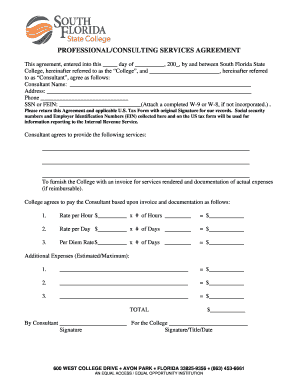

Set clear expectations with the client regarding payment terms, rates, and any additional expenses not included in the standard fee.

03

Create a detailed invoice template using software like pdfFiller, which allows users to easily customize and share their invoices.

04

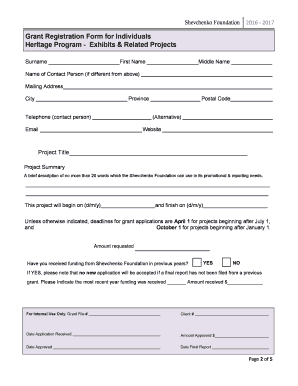

Maintain accurate records of the work performed, including the date, time, and description of each task or activity.

05

Regularly review and reconcile invoices to ensure accurate billing and prompt payment.

06

Communicate openly with clients about any changes in billing or additional fees that may arise during the course of the project.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.