Identity Theft Affidavit Definition

What is identity theft affidavit definition?

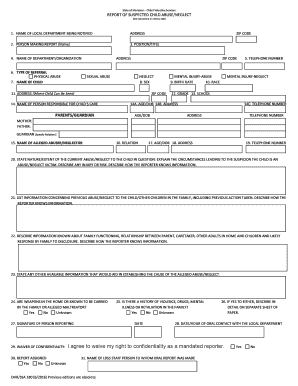

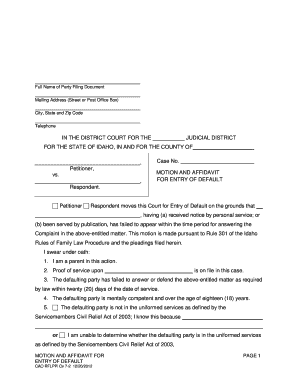

Identity theft affidavit definition refers to a legal document that victims of identity theft can use to report the fraudulent activity and begin the process of resolving the issues caused by the theft. It serves as a crucial tool for victims to prove their innocence and protect their financial and personal information.

What are the types of identity theft affidavit definition?

There are different types of identity theft affidavit definitions available depending on the jurisdiction and the specific requirements of the reporting agency. Some common types include:

How to complete identity theft affidavit definition

Completing an identity theft affidavit is an essential step in the process of reporting and resolving identity theft issues. Here is a step-by-step guide to help you complete the identity theft affidavit:

pdfFiller, an industry-leading online document management platform, empowers users to effortlessly create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users can rely on to get their documents done efficiently and securely.