Income And Expenditure Template For Small Business

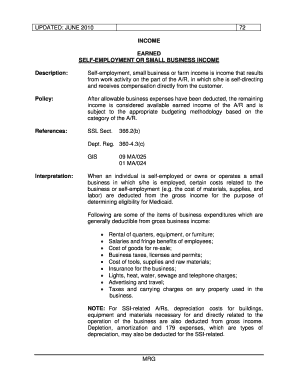

What is income and expenditure template for small business?

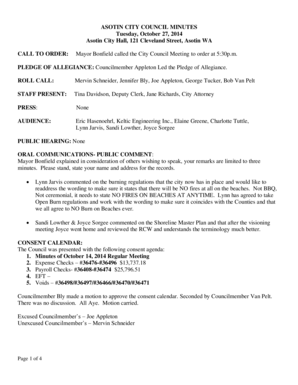

An income and expenditure template for small business is a document that helps track and analyze the financial transactions of a small business. It provides a structured framework to record income sources and expenses, allowing business owners to evaluate their financial performance and make informed decisions. With an income and expenditure template, you can easily monitor cash flow, assess profit margins, and identify areas for cost-saving or revenue growth.

What are the types of income and expenditure template for small business?

There are several types of income and expenditure templates available for small businesses, each designed to cater to specific needs and requirements. Some common types include:

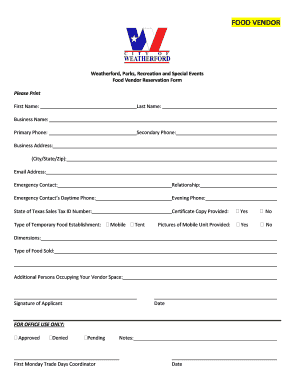

How to complete income and expenditure template for small business

Completing an income and expenditure template for a small business is a relatively simple process. Here are the steps you can follow:

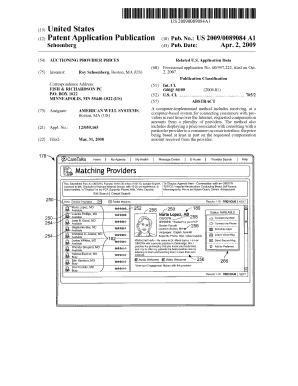

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.