Invoice Tracking System

What is invoice tracking system?

An invoice tracking system is a tool designed to help businesses monitor the status of invoices, from creation to payment. It allows users to keep track of all their invoices in one place, ensuring they are paid on time and helping to improve cash flow.

What are the types of invoice tracking system?

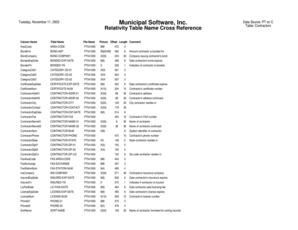

There are different types of invoice tracking systems available, each offering unique features to suit various business needs. Some common types include:

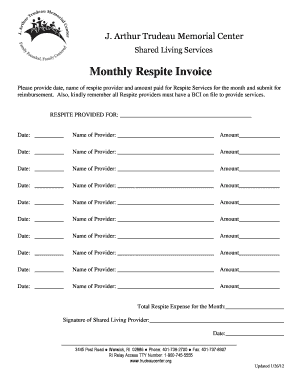

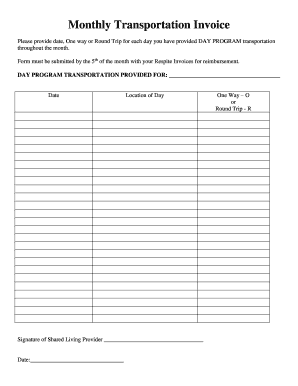

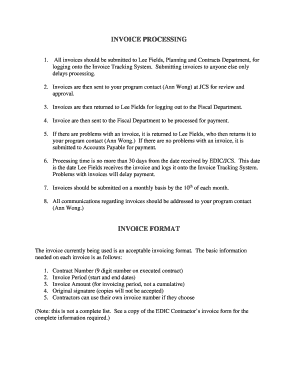

How to complete invoice tracking system

Completing an invoice tracking system is essential for maintaining accurate financial records and ensuring timely payments. Here are some steps to help you complete your invoice tracking system:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.