Payment Tracker Excel

What is payment tracker excel?

Payment tracker excel is a spreadsheet program that helps users track their payments and expenses. It provides a convenient way to organize and manage financial transactions, allowing users to easily input, calculate, and analyze payment data.

What are the types of payment tracker excel?

There are various types of payment tracker excel templates available to suit different needs and purposes. Some common types include:

Monthly payment tracker: Helps track monthly payments and expenses.

Invoice tracker: Specifically designed for tracking invoices and payments from clients or customers.

Expense tracker: Focuses on tracking various types of expenses, such as travel costs, office supplies, and utilities.

Loan payment tracker: Specifically designed for tracking loan payments and calculating interest.

Budget planner: A comprehensive payment tracker that helps users manage their budget, track expenses, and plan for future payments.

How to complete payment tracker excel

Completing a payment tracker excel is a straightforward process. Here are the steps to follow:

01

Open the payment tracker excel template in your preferred spreadsheet program.

02

Enter the necessary payment details, such as payment date, description, amount, and recipient.

03

Use formulas or functions to automatically calculate totals and generate reports.

04

Regularly update the tracker with new payments and expenses.

05

Save the completed payment tracker excel file to your desired location for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

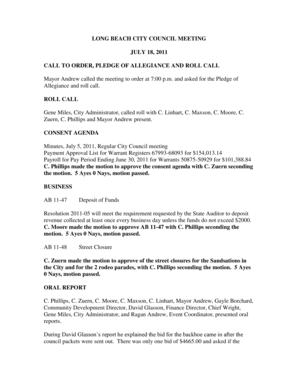

Does Excel have a scheduling template?

Many calendar templates are available for use in Microsoft Excel. A template provides a basic calendar layout that you can easily adapt for your needs.

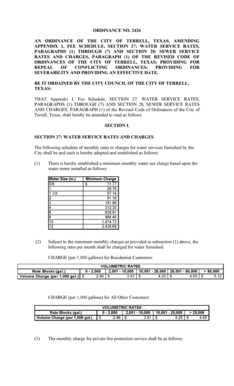

How do I track a vendor payment in Excel?

Accounts Payable Ledger First Six Columns Date: Enter the date that is shown on the vendor invoice. Invoice Number: Enter the invoice number that is shown on the vendor invoice. Vendor's Name: Enter the vendor's name. Description: Enter a brief description of the type of purchase.

How do I keep track of monthly payments in Excel?

Step by Step Procedures to Keep Track of Customer Payments in Excel STEP 1: Headline Entry for Customer Payments in Excel. Firstly, open an Excel worksheet. STEP 2: Input Customer Payments and Apply Data Validation. STEP 3: Create Dynamic Payment Details. STEP 4: Compute Total Bill. STEP 5: Generate Dynamic Payments Summary.

How do I create a dynamic tracker?

Dynamic Trackers are created by setting up additional URL Parameters on your Tracker's click or impression tracking links. In the above example we take a Campaign Tracker and add in Ad Group and Ad values to create a Dynamic Ad Tracker.

How do I create a monthly payment in Excel?

=PMT(17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two years. The rate argument is the interest rate per period for the loan. For example, in this formula the 17% annual interest rate is divided by 12, the number of months in a year.

How do you keep track of invoices and payments?

How to keep track of payments received Use a uniform template for invoices and verify all payment information to avoid processing delays. Put a follow-up system in place for late invoices. Keep on track of your financial reports. Use accounting software to automate the process.

Related templates