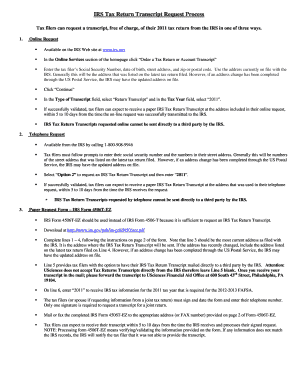

Irs Form 4506t-ez

What is irs form 4506t-ez?

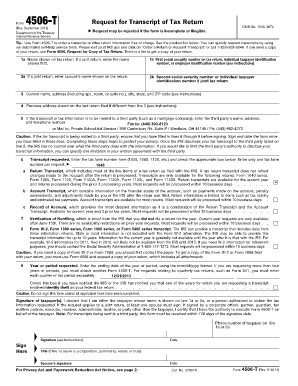

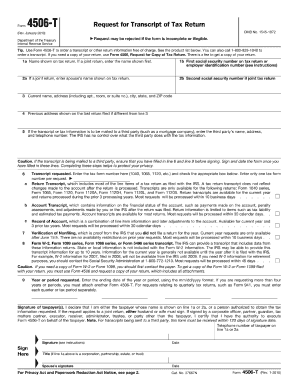

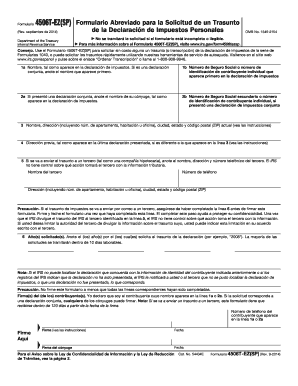

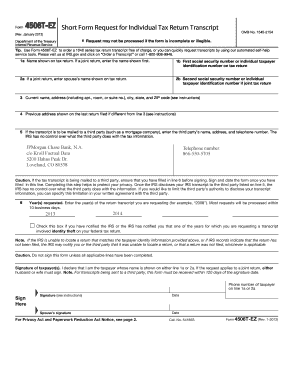

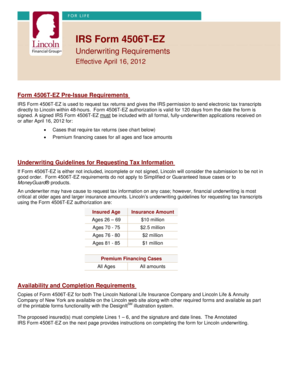

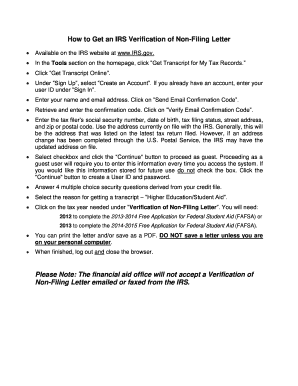

IRS Form 4506T-EZ is a document issued by the Internal Revenue Service (IRS) that allows individuals to request a copy of their tax return transcript or Verification of Nonfiling letter. This form is often required when applying for a loan or financial assistance, as it provides proof of income and tax filing status.

What are the types of irs form 4506t-ez?

There is only one type of IRS Form 4506T-EZ, which is used for requesting tax return transcripts or Verification of Nonfiling letters. However, the form may vary depending on the year of the tax return being requested.

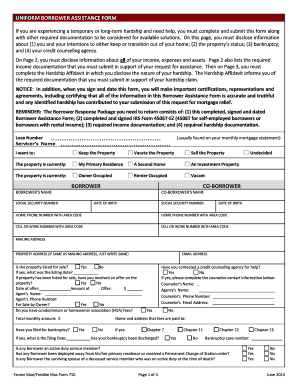

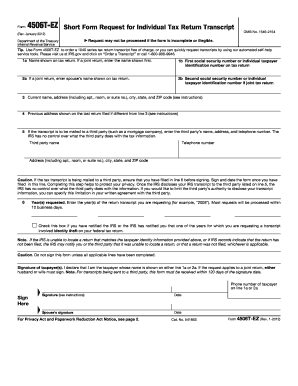

How to complete irs form 4506t-ez

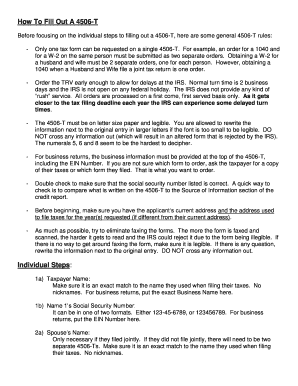

To complete IRS Form 4506T-EZ, follow these steps:

Remember, the information provided on IRS Form 4506T-EZ should be accurate and complete to ensure the timely processing of your request. If you have any questions or need further assistance, consult the IRS instructions or reach out to a tax professional. Additionally, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.