Limited Power Of Attorney California

What is limited power of attorney california?

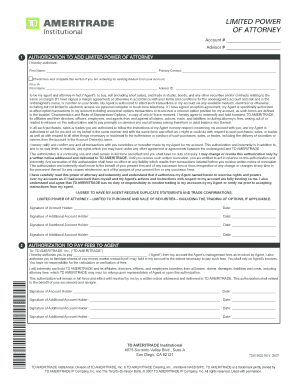

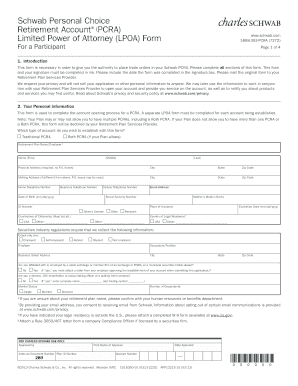

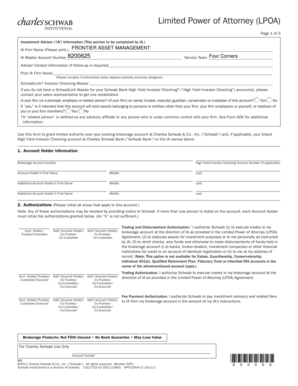

Limited power of attorney California is a legal document that grants someone the authority to make certain decisions and act on someone else's behalf, but only for specific and limited purposes. This document is often used when someone wants to appoint a trusted individual to handle specific matters, such as financial or medical decisions, while they are unavailable or unable to do so themselves.

What are the types of limited power of attorney california?

In California, there are several types of limited power of attorney, including: 1. Financial Power of Attorney: This grants authority related to financial matters, such as managing bank accounts, paying bills, or selling property. 2. Medical Power of Attorney: This grants authority related to medical decisions, such as making healthcare choices or consenting to medical treatments. 3. Real Estate Power of Attorney: This grants authority related to real estate transactions, such as buying or selling property. 4. Childcare Power of Attorney: This grants authority related to childcare decisions, such as making educational or healthcare choices for a child. 5. Vehicle Power of Attorney: This grants authority related to vehicle-related matters, such as registering, selling, or transferring ownership of a vehicle.

How to complete limited power of attorney california

To complete a limited power of attorney in California, follow these steps: 1. Choose the type of limited power of attorney that suits your needs. 2. Identify the person you want to appoint as your attorney-in-fact. 3. Clearly state the powers and limitations of the attorney-in-fact. 4. Specify the duration of the power of attorney. 5. Sign the document in the presence of a notary public. 6. Provide copies of the document to relevant parties, such as financial institutions or healthcare providers.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.