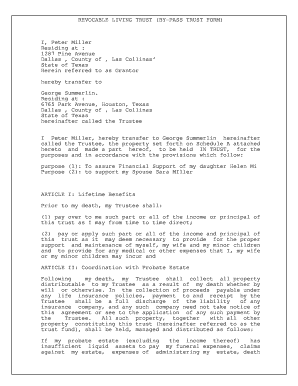

Living Trust Form - Page 2

What is Living Trust Form?

A Living Trust Form is a legal document that allows an individual to transfer their assets to a trust during their lifetime, ensuring smooth management and distribution of those assets after their demise. It is a way to avoid probate and provide specific instructions for the management and distribution of assets to beneficiaries.

What are the types of Living Trust Form?

There are primarily two types of Living Trust Forms:

Revocable Living Trust: This type of Living Trust allows the trustor to make changes, modify, or revoke the trust during their lifetime. The trust assets remain under the trustor's control until their death or incapacitation.

Irrevocable Living Trust: This type of Living Trust cannot be modified or revoked once created. The trust assets are transferred and managed by the trustee, providing benefits such as asset protection, tax advantages, and Medicaid qualification.

How to complete Living Trust Form

Completing a Living Trust Form can be done in a few simple steps:

01

Gather necessary information: Collect all relevant information about your assets, beneficiaries, and any specific instructions for their management and distribution.

02

Choose a template: Use a trusted online platform like pdfFiller to access a Living Trust Form template. pdfFiller empowers users to create, edit, and share documents online.

03

Fill out the form: Enter the required information accurately in the designated fields of the Living Trust Form. Make sure to review and double-check all the details.

04

Review and sign: Carefully review the completed form for any errors or omissions. Once satisfied, sign the form as the trustor in the presence of a notary public.

05

Notify relevant parties: Inform your beneficiaries and any other relevant parties about the existence of the Living Trust and provide them with copies of the signed document.

With pdfFiller, creating and completing your Living Trust Form is easy and convenient. Their unlimited fillable templates and powerful editing tools make it the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out Living Trust Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I set up a living trust in Washington state?

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it. A living trust is an effective tool that can provide you with the flexibility and privacy you seek.

How much does it cost to set up a trust in Florida?

How much does it cost to set up a living trust in Florida? A typical cost for an attorney to prepare a revocable living trust in Florida is between $2,000 and $3,000, depending on the attorney's experience.

What is the cost of a living trust in Washington state?

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

Is a trust worth the cost?

A trust can be a useful estate-planning tool for lots of people. But given the expenses associated with opening one, it's probably not worth it unless you have a certain amount of assets.

How do I file a living trust in Arizona?

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

Is a trust a good idea in Florida?

If your main goal is to avoid probate court, so long as you have assets that will not pass through probate then you will not need a trust. However, if you have assets that will pass through probate, the a Florida revocable living trust will be a good idea.

Related templates