Mileage Reimbursement Form 2016

What is mileage reimbursement form 2016?

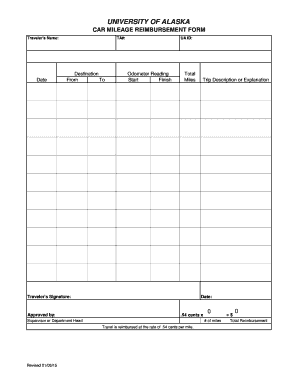

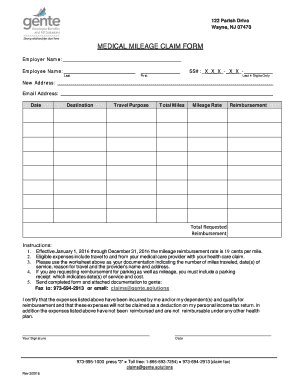

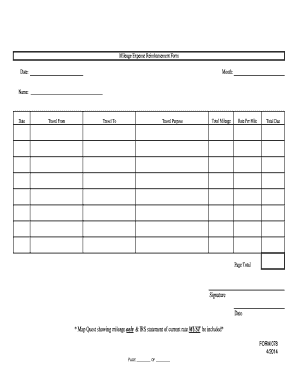

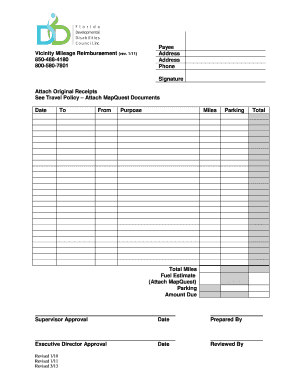

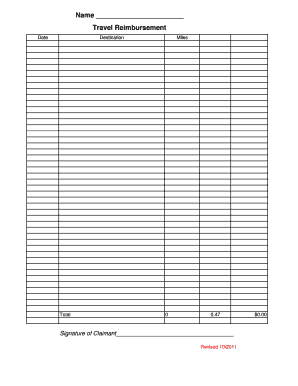

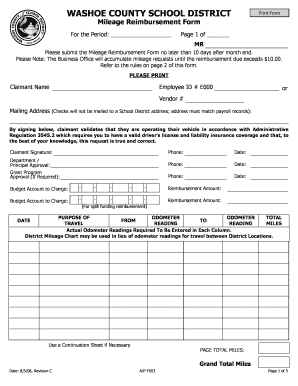

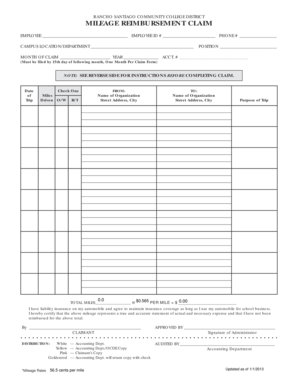

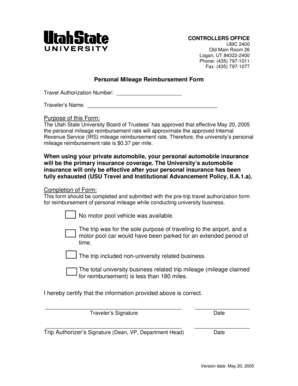

The mileage reimbursement form 2016 is a document used to request reimbursement for the miles traveled during the year 2016 for business purposes. It is used by employees who use their personal vehicles for work-related activities and need to be compensated for the expenses they incur. The form includes various fields where the employee can provide details such as the date of travel, the starting and ending locations, and the purpose of the trip. It is important to accurately fill out the form to ensure timely and accurate reimbursement.

What are the types of mileage reimbursement form 2016?

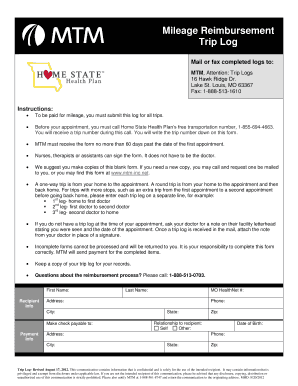

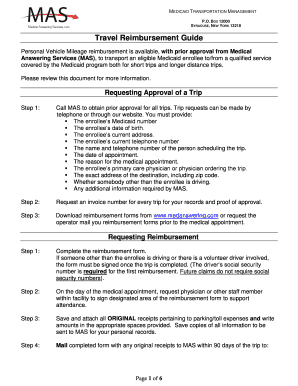

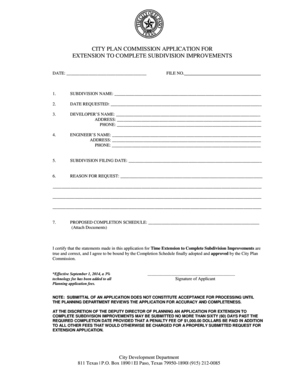

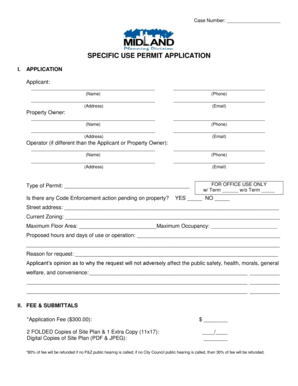

There are different types of mileage reimbursement forms for the year 2016 depending on the organization and its specific requirements. Some common types include:

How to complete mileage reimbursement form 2016

Completing the mileage reimbursement form 2016 is a straightforward process. Here are the steps to follow:

By using pdfFiller, you can easily create, edit, and share your mileage reimbursement form 2016 online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process, ensuring that your documents are done efficiently and professionally.