Monthly Budget Template Excel

What is monthly budget template excel?

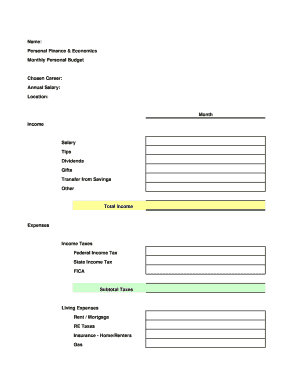

A monthly budget template excel is a tool that helps individuals or businesses track and manage their financials on a monthly basis. It is a spreadsheet template created in Microsoft Excel that allows users to input their income, expenses, and other financial information to calculate their monthly budget.

What are the types of monthly budget template excel?

There are several types of monthly budget template excel available, each designed to suit different needs. Some common types include:

Basic Monthly Budget Template: This template includes basic income and expense categories and is suitable for individuals or households with straightforward financial needs.

Business Monthly Budget Template: This template is designed for businesses and includes additional sections for tracking revenue, expenses, and profit margins.

Family Monthly Budget Template: This template is specifically designed for families and includes sections to track various family-related expenses, such as groceries, childcare, and education.

Project Monthly Budget Template: This template is useful for tracking expenses and income related to a specific project or event. It helps individuals or businesses monitor their spending and ensure they stay within budget.

How to complete monthly budget template excel

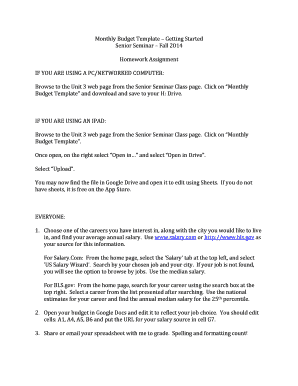

Completing a monthly budget template excel is a straightforward process. Here are the steps to follow:

01

Open the monthly budget template excel using Microsoft Excel or a compatible spreadsheet software.

02

Input your income sources in the designated section of the template. This may include salaries, rental income, investment returns, or any other sources of income.

03

Enter your expenses in the appropriate categories. These can include rent or mortgage payments, utilities, groceries, transportation costs, and any other regular or one-time expenses.

04

Calculate your totals by summing up the income and expenses sections. The template may also provide automatic calculations for you.

05

Analyze your budget by comparing your income and expenses. Identify areas where you can potentially cut down expenses or increase income to achieve a balanced budget.

06

Make adjustments as necessary to ensure your budget is feasible and aligns with your financial goals.

07

Regularly review and update your monthly budget template excel to keep track of your financial progress and make necessary adjustments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out monthly budget template excel

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does Excel have a monthly budget template?

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

How do I create a monthly budget?

How to make a monthly budget: 5 steps Calculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month. Spend a month or two tracking your spending. Think about your financial priorities. Design your budget. Track your spending and refine your budget as needed.

How should a beginner budget?

Follow the steps below as you set up your own, personalized budget: Make a list of your values. Write down what matters to you and then put your values in order. Set your goals. Determine your income. Determine your expenses. Create your budget. Pay yourself first! Be careful with credit cards. Check back periodically.

What is the 50 30 30 budget rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

How do I create a monthly budget template in Excel?

How to Create a Budget Spreadsheet in Excel Identify Your Financial Goals. Determine the Period Your Budget Will Cover. Calculate Your Total Income. Begin Creating Your Excel Budget. Enter All Cash, Debit and Check Transactions into the Budget Spreadsheet. Enter All Credit Transactions.

What are the 7 steps in creating a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

Related templates