Mortgage Letter Templates - Page 2

What are Mortgage Letter Templates?

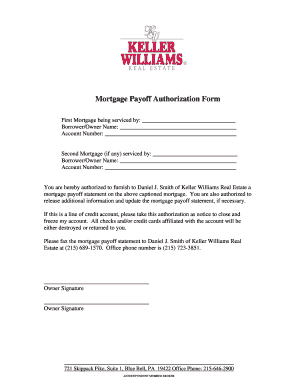

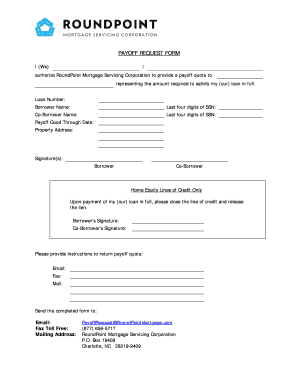

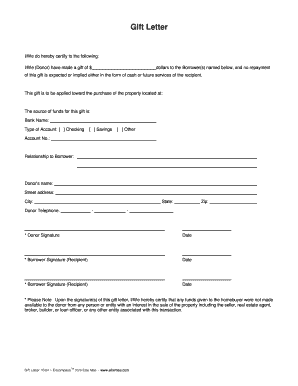

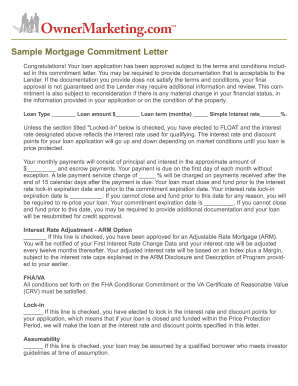

Mortgage Letter Templates are pre-designed forms or letters that individuals can use when communicating with their mortgage lenders. These templates provide a structured format and include all the necessary information required for a specific purpose, such as requesting a loan modification, informing about a change of address, or disputing an error on the mortgage statement.

What are the types of Mortgage Letter Templates?

There are various types of Mortgage Letter Templates available to suit different needs. Some common types include:

How to complete Mortgage Letter Templates

Completing Mortgage Letter Templates is a simple process that can be done by following these steps:

By utilizing Mortgage Letter Templates, borrowers can streamline their communication with mortgage lenders and ensure that all the essential details are included in their letters. pdfFiller, an online document editing platform, offers a wide range of fillable Mortgage Letter Templates and powerful editing tools to aid users in creating, editing, and sharing their documents hassle-free. With unlimited access to templates and user-friendly features, pdfFiller is the ultimate PDF editor that encourages efficiency and productivity in managing mortgage-related correspondence.