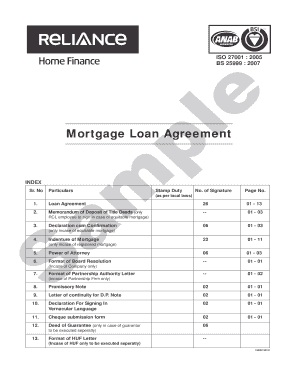

What is a mortgage loan agreement sample?

A mortgage loan agreement sample is a template document that outlines the terms and conditions of a mortgage loan. It includes important information such as the loan amount, repayment schedule, interest rate, and any additional provisions or clauses that may be applicable. By using a sample agreement, lenders and borrowers can have a clear understanding of the terms and conditions before finalizing the mortgage loan agreement.

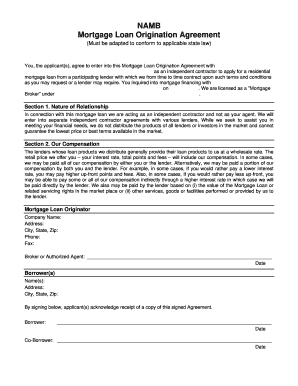

What are the types of mortgage loan agreement samples?

There are several types of mortgage loan agreement samples available, each tailored to specific situations. These include:

Fixed-rate mortgage loan agreement: This type of agreement has a fixed interest rate for the duration of the loan.

Adjustable-rate mortgage loan agreement: This agreement allows the interest rate to fluctuate based on market conditions.

Interest-only mortgage loan agreement: With this type of agreement, borrowers only pay the interest on the loan for a certain period before starting to pay the principal.

Balloon mortgage loan agreement: This agreement involves low monthly payments initially and a large payment (balloon payment) at the end of the loan term.

Reverse mortgage loan agreement: Designed for older homeowners, this agreement allows them to convert a portion of their home equity into cash without having to sell the property.

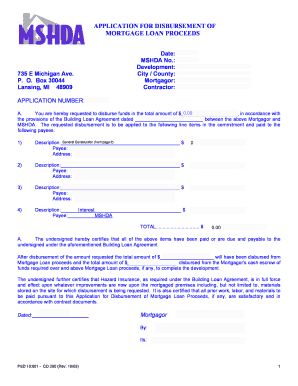

How to complete a mortgage loan agreement sample

Completing a mortgage loan agreement sample is a straightforward process. Follow these steps:

01

Gather all necessary information: Collect all the required financial and personal information of both the lender and the borrower.

02

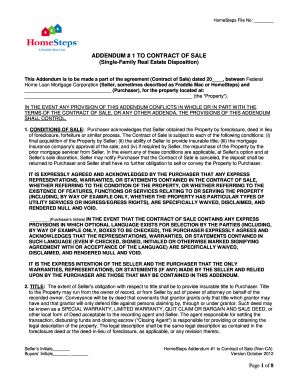

Review and customize the sample agreement: Carefully read through the sample agreement and make any necessary changes or additions to match the specific terms and conditions of the mortgage loan.

03

Fill in the blanks: Fill in all the required blanks and fields in the agreement, including names, addresses, loan amount, interest rate, repayment schedule, and any other relevant details.

04

Review and finalize: Double-check all the information entered and ensure its accuracy. Once satisfied, both parties should carefully review and sign the agreement.

05

Keep a copy: Each party involved should keep a copy of the signed mortgage loan agreement for their records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.