Mortgage Release Letter

What is a mortgage release letter?

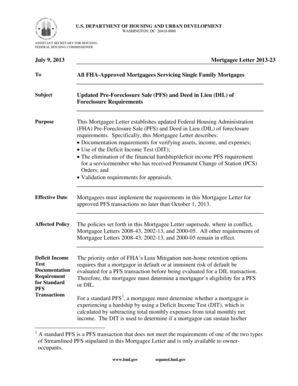

A mortgage release letter, also known as a discharge of mortgage, is a legal document that signifies the end of a mortgage agreement. It is a confirmation that the borrower has fully paid off the loan, and the lender no longer holds any claim on the property. This letter is an important record that ensures the property is free from any liens or encumbrances.

What are the types of mortgage release letter?

There are two main types of mortgage release letter:

Full Release: A full release letter is issued when the borrower has completely paid off the entire mortgage loan amount, including all interest and fees.

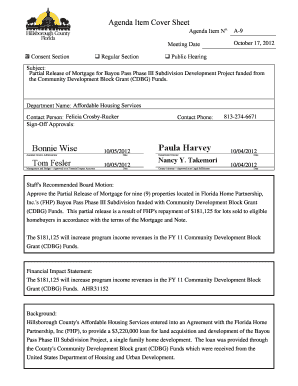

Partial Release: A partial release letter is given when the borrower has paid off a portion of the mortgage amount, usually due to refinancing or selling a part of the property.

How to complete a mortgage release letter

To complete a mortgage release letter, follow these steps:

01

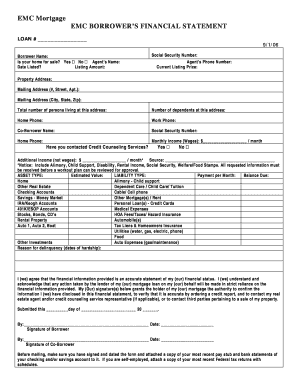

Begin the letter by stating the names of the parties involved – the lender and the borrower.

02

Include the date when the mortgage was originally taken out and the current date.

03

Clearly state that the loan has been fully paid off or partially paid off, depending on the circumstances.

04

Provide the details of the property, such as the address and any relevant legal descriptions.

05

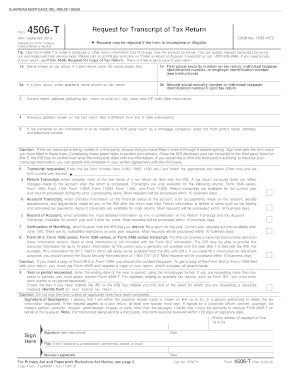

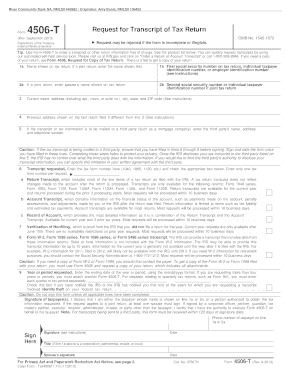

Mention any additional documents that should be attached, such as proof of payment or satisfaction of liens.

06

Sign and date the letter, ensuring that both the lender and the borrower have signed it.

07

Keep a copy of the letter for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out mortgage release letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you release a mortgage?

When you pay off your loan and you have a mortgage, the lender will send you — or the local recorder of deeds or office that handles the filing of real estate documents — a release of mortgage. This release of mortgage is recorded or filed and gives notice to the world that the lien is no more.

Who is responsible for releasing a mortgage?

You, your lawyer or your notary must discharge the mortgage and add your new lender to your property's title. Some lenders charge other fees, including assignment fees when you switch to another lender. Ask your new lender if they will cover the costs of a mortgage discharge.

How do I prove my mortgage is paid off?

State property records will show whether your lien is released. You can find information on property records by contacting your local Secretary of State or county recorder of deeds. After you pay off your mortgage, your lender should also return the original note to you.

What is a mortgage release statement?

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

What does it mean to release a loan?

Once all the money has been fully paid back to the lender a Loan Release Form is created and issued to the borrower relieving them from any liability from the note.

What is a mortgage discharge statement?

Discharging a mortgage means recording a mortgage discharge with the registry to release the Bank's collateral hold on your home. Generally, you will pay the cost to register the discharge and possibly a discharge fee to your lender.

Related templates