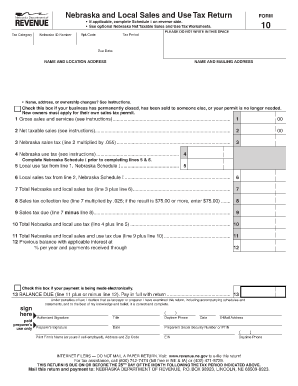

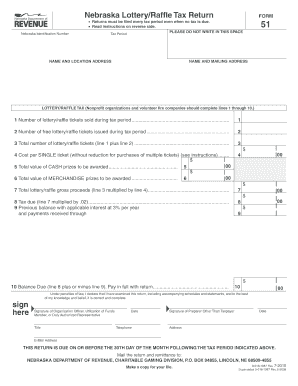

Nebraska Department Of Revenue Form 6

What is Nebraska Department of Revenue Form 6?

Nebraska Department of Revenue Form 6 is a document used by taxpayers in Nebraska to report and pay their income tax. This form is specifically designed for individuals who have income from sources other than wages, such as self-employment income, rental income, or investment income. By filling out and submitting Form 6, taxpayers fulfill their obligation to report their income accurately to the Nebraska Department of Revenue.

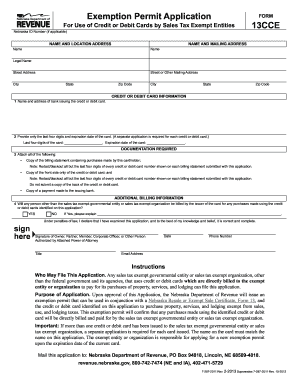

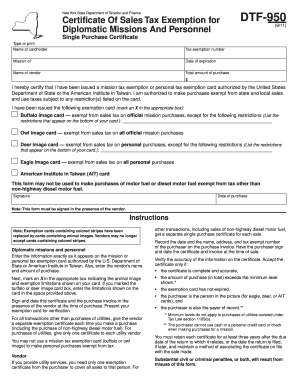

What are the types of Nebraska Department of Revenue Form 6?

There are different types of Nebraska Department of Revenue Form 6, each tailored to specific taxpayer situations. The most common types of Form 6 include: 1. Form 6 - Individual Income Tax Return: This is the standard Form 6 used by most individual taxpayers who have income from non-wage sources. 2. Form 6N - Nonresident and Part-Year Resident Income Tax Return: This form is for individuals who are not full-year residents of Nebraska, but still have income from Nebraska sources. 3. Form 6X - Amended Nebraska Individual Income Tax Return: This form is used to correct errors or make changes to a previously filed Form 6.

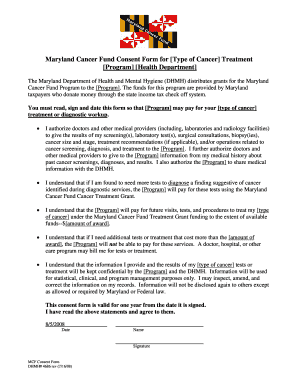

How to complete Nebraska Department of Revenue Form 6

Completing Nebraska Department of Revenue Form 6 is a straightforward process. Here are the steps you need to follow: 1. Gather all necessary information: Collect all the documents that you will need to accurately report your income, deductions, and credits. 2. Provide personal information: Fill in your name, address, Social Security number, and other required personal details. 3. Report income: Enter the details of your income from non-wage sources, such as self-employment income, rental income, or investment income. 4. Deductions and credits: Claim any eligible deductions and credits that may reduce your taxable income or increase your tax refund. 5. Calculate tax liability: Use the provided instructions to calculate your tax liability based on the reported income and deductions. 6. Sign and submit: Sign the form electronically or physically, depending on the submission method, and submit it to the Nebraska Department of Revenue.

pdfFiller makes the process of completing Nebraska Department of Revenue Form 6 even easier. With its user-friendly interface and comprehensive tools, pdfFiller simplifies the task of filling out the form accurately and submitting it electronically. Start using pdfFiller today to streamline your tax reporting process and ensure compliance with Nebraska tax laws.