New Employee Forms 2016

What is new employee forms 2016?

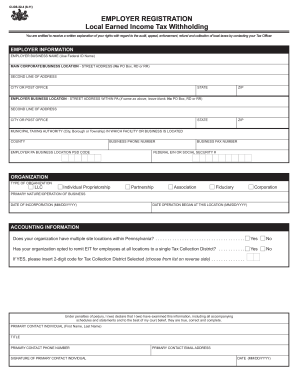

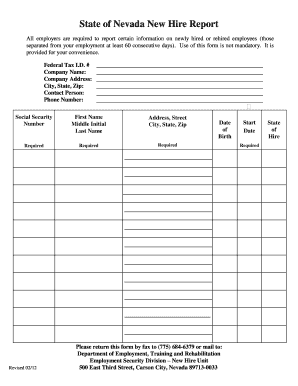

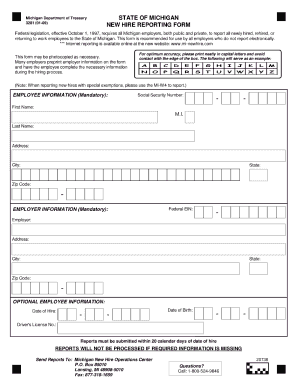

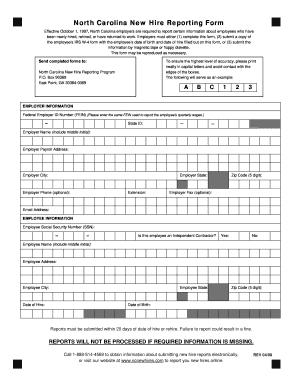

New employee forms 2016 refer to the collection of documents that employers require their new hires to fill out and submit. These forms contain important information about the employee, such as personal details, tax information, and emergency contacts. By completing these forms, employers can ensure that they have all the necessary information to properly onboard and compensate their new employees.

What are the types of new employee forms 2016?

The types of new employee forms 2016 may vary depending on the specific requirements of each employer. However, some commonly used forms include:

W-4 Form: This form is used to determine the employee's federal tax withholdings.

I-9 Form: This form is used to verify the employee's eligibility to work in the United States.

Direct Deposit Authorization Form: This form is used to set up direct deposit for the employee's salary.

Emergency Contact Form: This form collects information about the employee's emergency contacts in case of any unforeseen circumstances.

How to complete new employee forms 2016

To complete new employee forms 2016, follow these steps:

01

Carefully read each form and understand the information required.

02

Fill out the forms accurately, providing all the necessary details.

03

Double-check your entries for any errors or omissions.

04

Sign and date the forms where required.

05

Submit the completed forms to your employer within the specified timeline.

By following these steps, you can ensure that your new employee forms 2016 are properly completed and submitted to your employer.

Video Tutorial How to Fill Out new employee forms 2016

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What employees Cannot use form 2106?

E G Yes No No Don't file Form 2106. No A Were you employed as an Armed Forces reservist, a qualified performing artist, a fee-basis state or local government official, or an individual with a disability claiming impairment-related work expenses? See the line 10 instructions for definitions.

Who can claim form 2106?

Form 2106 may be used only by Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses because of the suspension of miscellaneous itemized deductions subject to the 2% floor under section 67(a) by P.L. 115-97, section 11045

What is the 2106 form on tax returns?

Employees file this form to deduct ordinary and necessary expenses for their job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business.

What is a 2106 form used for?

Employees file this form to deduct ordinary and necessary expenses for their job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business.

What forms do I need to fill out as a new employee?

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How can I get my W-2 form from 2016?

Please visit irs.gov and click on “Get Your Tax Record” to request a wage and income transcript containing your W-2 information. If you are unable to use the IRS online request option, you can complete an IRS Form 4506-T.

Related templates