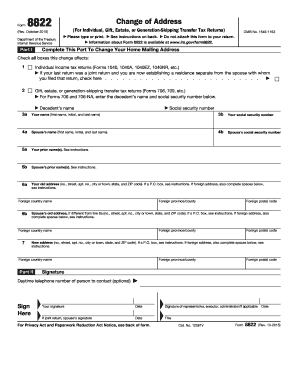

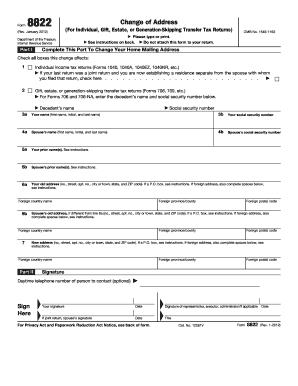

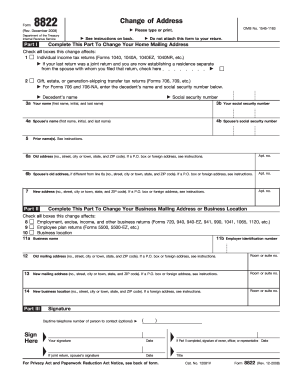

8822 Form

What is 8822 Form?

The 8822 Form, also known as the Change of Address Form, is used to notify the Internal Revenue Service (IRS) about an individual's new address. This form is important for maintaining accurate records and ensuring that any future correspondence from the IRS reaches the right recipient. It is essential to update your address promptly to avoid any potential issues with your tax documents.

What are the types of 8822 Form?

There are two types of 8822 Forms: the individual form and the business form. 1. Individual Form - This form is used by individuals who need to update their address with the IRS. 2. Business Form - This form is used by businesses and organizations to inform the IRS about a change in their mailing address. Both forms serve the same purpose of updating address information, but they are specific to different entities.

How to complete 8822 Form

Completing the 8822 Form is a straightforward process. Here are the steps to follow: 1. Gather the necessary information - You will need details such as your old address, new address, social security number, and taxpayer identification number (for business forms). 2. Download the form - You can find the form on the IRS website or use a reliable platform like pdfFiller to access a fillable version. 3. Fill in the form - Enter your personal information and ensure accuracy to avoid any errors. 4. Sign and date the form - After reviewing the information, sign and date the form as required. 5. Submit the form - Send the completed form to the IRS address provided on the form. Remember to keep a copy of the form for your records and notify other relevant parties of your address change, such as your employer or financial institutions.

If you need to create, edit, and share documents online easily, pdfFiller is your ultimate solution. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to get their documents done efficiently. Make use of pdfFiller and streamline your document management process.