Payroll Error Correction Form

What is payroll error correction form?

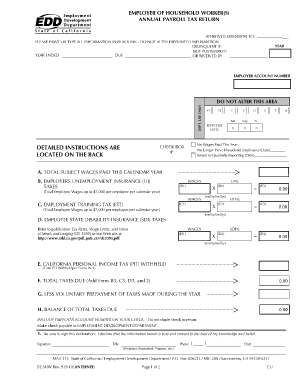

Payroll error correction form is a document used to correct any errors or mistakes in payroll processing. It allows employers to rectify any mistakes made in calculating wages, deductions, or taxes for their employees. This form ensures accurate and compliant payroll records.

What are the types of payroll error correction form?

There are various types of payroll error correction forms that employers can utilize based on the nature of the error. Some common types include: 1. Form W-2c: Used to correct errors on an employee's W-2 form, such as incorrect wages or tax withholding. 2. Form 941-X: Used to correct errors on quarterly payroll tax returns, such as mistakes in reporting wages, taxes, or deposits. 3. Form 1095-C: Used to correct errors on an employee's Form 1095-C related to employer-provided health insurance coverage. 4. State-specific payroll correction forms: Some states may have their own specific forms for correcting payroll errors.

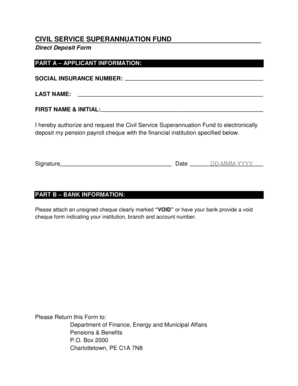

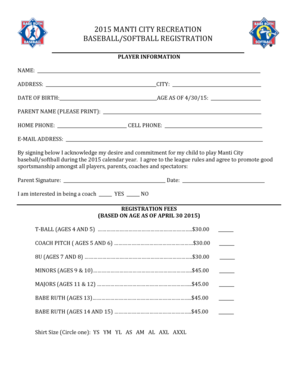

How to complete payroll error correction form

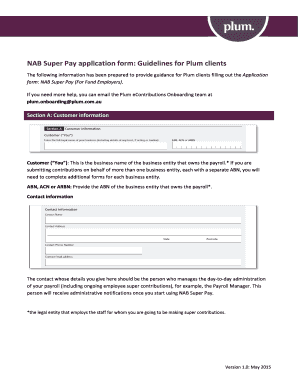

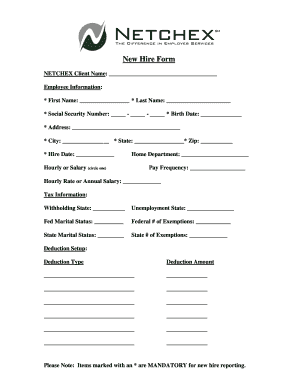

Completing a payroll error correction form may vary depending on the specific form being used. However, the general steps to complete the form are as follows: 1. Obtain the correct version of the payroll error correction form. 2. Provide your employer and employee identification details. 3. Identify the specific error that needs correction and explain it clearly. 4. Calculate and provide the correct figures or information. 5. Attach any supporting documentation if required. 6. Review the form for accuracy and completeness. 7. Sign and date the form. 8. Submit the form to the appropriate authority or department as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.