Personal Budget Planner

What is Personal Budget Planner?

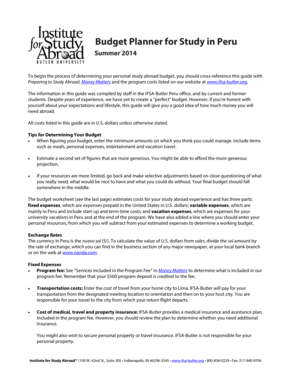

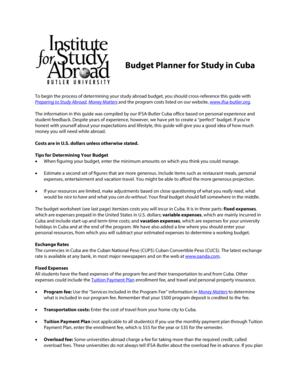

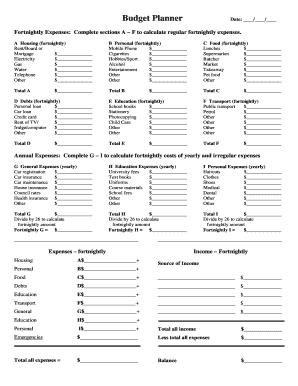

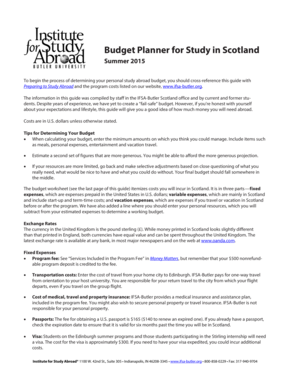

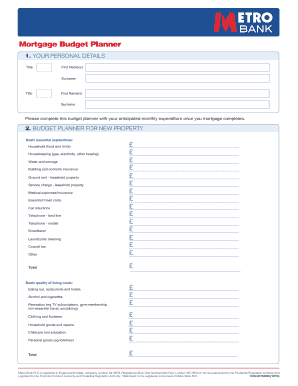

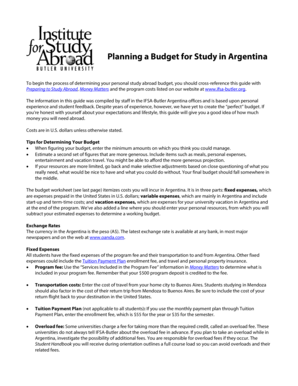

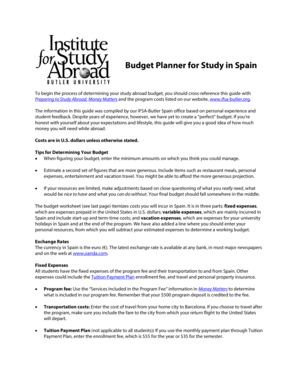

A Personal Budget Planner is a tool that helps individuals manage their finances. It allows users to track their income, expenses, and savings in an organized manner. With a Personal Budget Planner, users can set financial goals, create a budget, and monitor their progress towards achieving those goals.

What are the types of Personal Budget Planner?

There are various types of Personal Budget Planners available to cater to different financial needs. Some common types include:

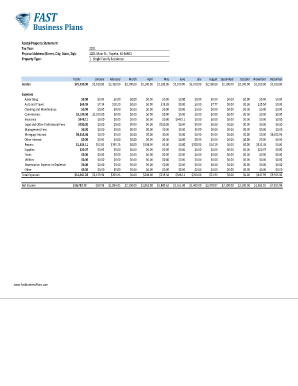

Spreadsheet-based Budget Planner: These are simple templates created using Microsoft Excel or Google Sheets. Users can manually enter their income and expenses to keep track of their finances.

Mobile Apps: There are several mobile applications available that offer Personal Budget Planning features. These apps often come with additional features like expense categorization, automatic expense tracking, and goal setting.

Online Budgeting Tools: Online platforms like Mint, Personal Capital, and YNAB (You Need A Budget) provide comprehensive Personal Budget Planning tools. These tools connect to users' bank accounts and automatically categorize expenses, provide detailed insights, and help users make informed financial decisions.

How to complete Personal Budget Planner

Completing a Personal Budget Planner can be done in a few simple steps. Here's how to do it:

01

Gather all your financial information, including income statements, bills, bank statements, and credit card statements.

02

List all your sources of income and categorize them as per their frequency (monthly, bi-weekly, etc.).

03

Determine your fixed monthly expenses, such as rent, mortgage payments, insurance premiums, and utilities.

04

Track your discretionary spending by analyzing your bank and credit card statements. Categorize these expenses as entertainment, dining out, shopping, etc.

05

Set financial goals and allocate a portion of your income towards savings and debt repayment.

06

Regularly update your Personal Budget Planner and compare your actual expenses with your budgeted amounts to identify areas for improvement.

07

Use the insights gained from your Personal Budget Planner to make informed financial decisions and adjust your spending habits accordingly.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a budget template in Excel?

How to Make a Budget in Excel from Scratch Step 1: Open a Blank Workbook. Step 2: Set Up Your Income Tab. Step 3: Add Formulas to Automate. Step 4: Add Your Expenses. Step 5: Add More Sections. Step 6.0: The Final Balance. Step 6.1: Totaling Numbers from Other Sheets. Step 7: Insert a Graph (Optional)

How do I create a personal budget spreadsheet?

A simple, step-by-step guide to creating a budget in Google Sheets Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget.

Does Excel have a budget template?

Creating a budgeting plan for your household can feel overwhelming and hard, but Excel can help you get organized and on track with a variety of free and premium budgeting templates.

Does Microsoft have a budget planner?

The Monthly Budget Planner helps you plan, manage, and track your budget on a monthly basis. You'll set up your spending plan at the beginning of the month, and track your spending throughout the month.

What is the best budget template in Excel?

Free Excel budget templates for 2022 Expense tracker by Sheetgo. Monthly Budget Planner by Money Under 30. Annual Budget Planner by Budget Templates. Student Budget template by Microsoft. Household Expense Budget by Smartsheet. Zero-based Budget Spreadsheet by Smartsheet. Money Manager template by Smartsheet.

How do you create a personal budget plan?

Create a Personal Budget: How to Make a Budget Gather your financial statement. Record all sources of income. Create a list of monthly expenses. Fixed Expenses. Variable Expenses. Total your monthly income and monthly expenses. Budget Spreadsheet Example. Set a goal.

Related templates