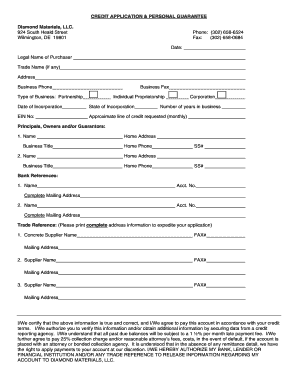

Personal Guarantee Template

What is a personal guarantee template?

A personal guarantee template is a legal document that outlines the responsibilities and liabilities of an individual who agrees to personally guarantee a loan or debt. This template provides a clear framework and terms for this agreement, ensuring that all parties involved are aware of their obligations and rights.

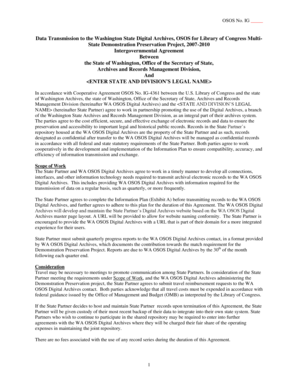

What are the types of personal guarantee templates?

There are several types of personal guarantee templates available, depending on the specific purpose and requirements. Some common types include:

How to complete a personal guarantee template

Completing a personal guarantee template is a straightforward process. Follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.