Personal Profit And Loss Statement

What is personal profit and loss statement?

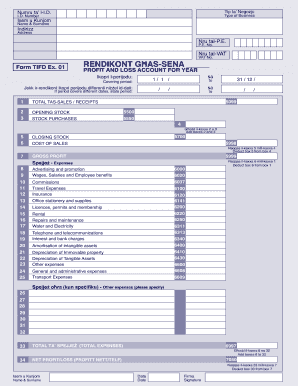

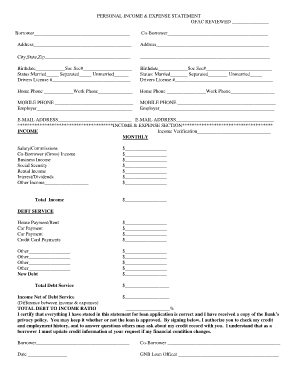

A personal profit and loss statement is a financial document that provides an overview of an individual's income and expenses. It helps individuals assess their financial position by analyzing their sources of income and tracking their expenses. By understanding their personal profit and loss statement, individuals can make informed decisions about their financial goals and budgeting strategies.

What are the types of personal profit and loss statement?

There are two main types of personal profit and loss statements: cash basis and accrual basis. 1. Cash basis: This type of statement records income and expenses when they are actually received or paid. It focuses on the cash flow of an individual and provides a more immediate snapshot of their financial situation. 2. Accrual basis: This type of statement records income and expenses when they are earned or incurred, regardless of when the actual cash is received or paid. It provides a more comprehensive view of an individual's financial position by including accounts receivable and accounts payable.

How to complete personal profit and loss statement

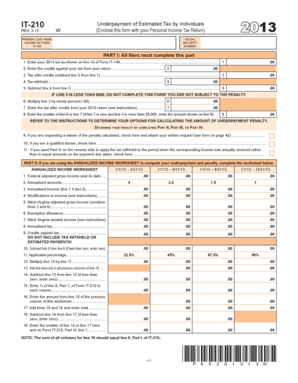

Completing a personal profit and loss statement involves the following steps: 1. Gather all financial documents: Collect all relevant documents such as bank statements, receipts, invoices, and financial statements. 2. Categorize income and expenses: Sort income and expenses into categories such as salary, rental income, utilities, groceries, etc. 3. Calculate total income and expenses: Add up the amounts for each category to determine the total income and total expenses. 4. Calculate net profit or loss: Subtract total expenses from total income to calculate the net profit or loss. 5. Analyze the results: Assess the net profit or loss to understand your financial position and identify areas for improvement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.