Private Placement Memorandum Vs Offering Memorandum

What is private placement memorandum vs offering memorandum?

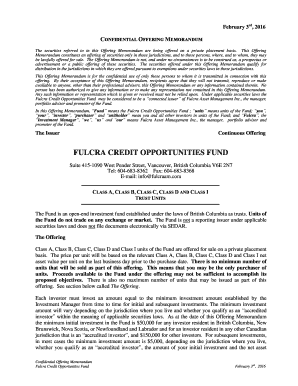

Private placement memorandum (PPM) and offering memorandum (OM) are both documents used in the process of raising capital for a company. However, there are some key differences between the two. A private placement memorandum is a legal document that outlines the terms and conditions of an investment offering made to a specific group of investors. It provides detailed information about the company, its business model, financial statements, and the potential risks involved. On the other hand, an offering memorandum is a broader term that refers to a disclosure document used to provide information about a securities offering to potential investors. While both documents serve a similar purpose of providing investors with important information, private placement memorandums are typically used for offerings that are exempt from registration with regulatory authorities, whereas offering memorandums are used for offerings that are registered with such authorities.

What are the types of private placement memorandum vs offering memorandum?

There are various types of private placement memorandum (PPM) and offering memorandum (OM) depending on the nature of the investment offering. Some common types include:

How to complete private placement memorandum vs offering memorandum

Completing a private placement memorandum (PPM) or offering memorandum (OM) involves several important steps. Here is a general guide on how to complete these documents:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.