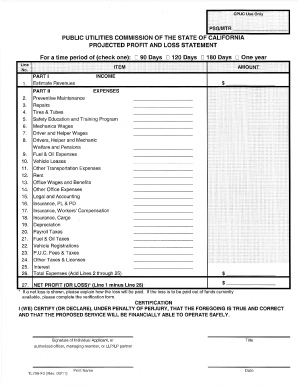

Profit And Loss Statement For Self Employed Homeowners

What is a profit and loss statement for self employed homeowners?

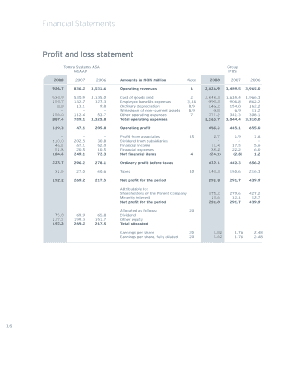

A profit and loss statement, also known as an income statement, is a financial document that summarizes the revenue, expenses, and net income of a self employed homeowner. It provides a snapshot of the financial health of the business, showing whether it is profitable or running at a loss. The profit and loss statement is an essential tool for self employed homeowners to assess the performance of their business and make informed financial decisions.

What are the types of profit and loss statement for self employed homeowners?

There are two main types of profit and loss statements for self employed homeowners: the cash basis method and the accrual basis method. 1. Cash Basis Method: This method records income and expenses when they are actually received or paid. It does not take into account any accounts receivable or accounts payable. 2. Accrual Basis Method: This method records income and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. It includes accounts receivable and accounts payable in the statement.

How to complete a profit and loss statement for self employed homeowners

Completing a profit and loss statement can seem daunting, but pdfFiller makes it easy and efficient. Here are the steps to follow: 1. Start by gathering all the necessary financial documents, such as bank statements, receipts, and invoices. 2. Open pdfFiller and create a new document. 3. Choose the profit and loss statement template that best fits your needs. 4. Enter your personal and business information in the designated fields. 5. Fill in the revenue section by entering the details of all your income sources. 6. Move on to the expenses section and list all your business expenses accurately. 7. Calculate the net income by subtracting the total expenses from the total revenue. 8. Review the statement for accuracy and make any necessary adjustments. 9. Save the completed profit and loss statement and share it electronically or print it for your records.

At pdfFiller, we understand the importance of a comprehensive profit and loss statement for self employed homeowners. Our platform empowers users to easily create, edit, and share professional-looking documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to confidently manage your financial statements and run your business successfully.