Profit And Loss Statement For Small Business

What is profit and loss statement for small business?

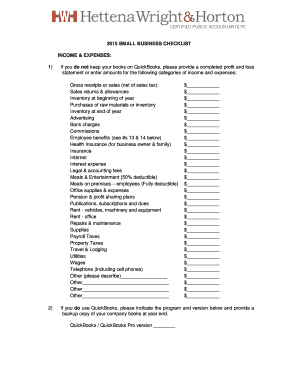

A profit and loss statement, also known as an income statement, is a financial document that provides an overview of a small business's revenues, costs, and expenses during a specific period. It shows whether the business has made a profit or incurred a loss. The statement includes information on sales, operating expenses, cost of goods sold, and other relevant financial data. It is an essential tool for business owners to assess their company's financial performance and make informed decisions.

What are the types of profit and loss statement for small business?

There are two main types of profit and loss statements for small businesses: single-step and multi-step. A single-step profit and loss statement is simpler and combines all revenues and gains in one category and all expenses and losses in another category. On the other hand, a multi-step profit and loss statement separates revenues, gains, expenses, and losses into different sections, providing a more detailed analysis of the business's financial performance. The choice between the two types depends on the complexity and reporting needs of the business.

How to complete profit and loss statement for small business

Completing a profit and loss statement for a small business involves several steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.