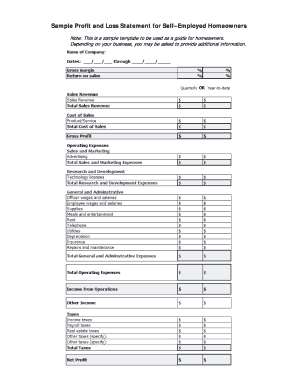

Profit And Loss Template - Page 2

What is Profit And Loss Template?

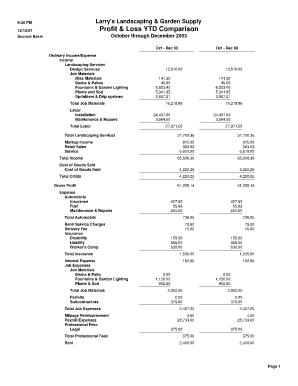

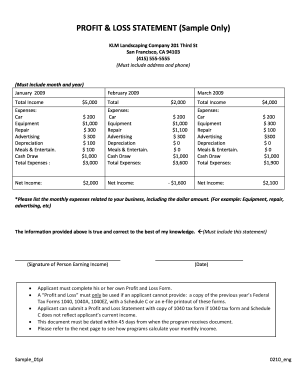

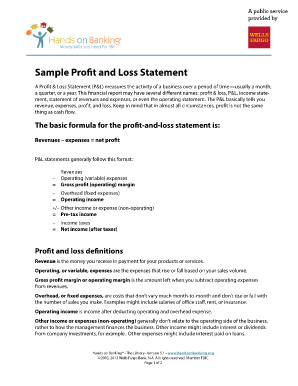

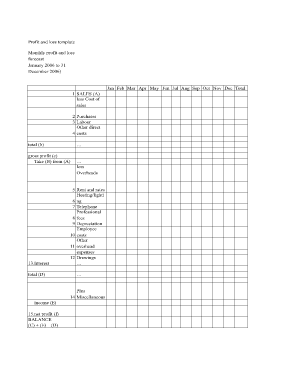

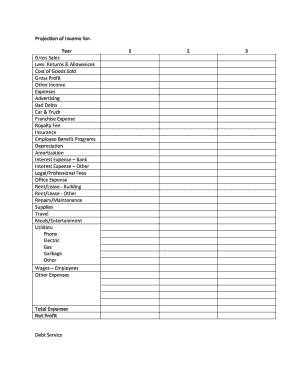

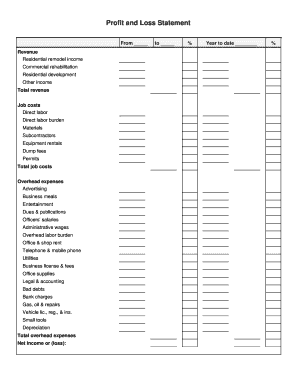

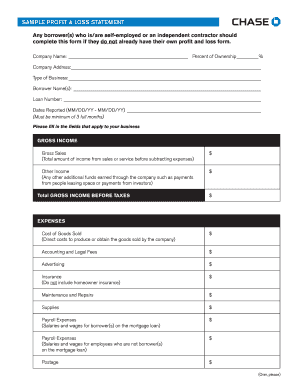

A Profit and Loss template is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time. It provides a clear picture of a company's financial performance and helps in analyzing its profitability.

What are the types of Profit And Loss Template?

There are several types of Profit and Loss templates that cater to specific business needs. Some common types include:

How to complete Profit And Loss Template

Completing a Profit and Loss template requires attention to detail and accurate financial data. Here are the steps to complete the template:

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents effortlessly. With unlimited fillable templates and robust editing tools, pdfFiller is the go-to PDF editor for getting documents done efficiently and professionally.