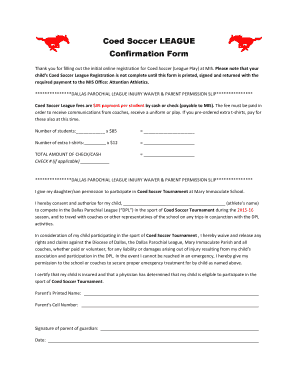

What is a profit and loss worksheet?

A profit and loss worksheet is a financial statement that provides a summary of a company's revenues, costs, and expenses during a specific period of time. It is used to assess the financial performance and profitability of a business. By analyzing the information in a profit and loss worksheet, businesses can make informed decisions to improve their operations and increase their profits.

What are the types of profit and loss worksheets?

There are several types of profit and loss worksheets that cater to different business needs. The main types include:

Single-Step Profit and Loss Worksheet: This type of worksheet calculates the total revenue and subtracts the total expenses to determine the net profit or loss.

Multi-Step Profit and Loss Worksheet: This type of worksheet provides more detailed information by segregating revenue, costs, and expenses into multiple sections such as operating income, non-operating income, and taxes.

Comparative Profit and Loss Worksheet: This type of worksheet compares the financial performance of a business over multiple periods, allowing businesses to assess their growth or decline.

Projected Profit and Loss Worksheet: This type of worksheet forecasts the potential financial performance of a business based on anticipated revenues and projected expenses.

How to complete a profit and loss worksheet?

Completing a profit and loss worksheet involves several key steps:

01

Gather all relevant financial documents, including income statements, balance sheets, and expense records.

02

Input the revenue details in the appropriate section of the worksheet. This includes sales, service fees, and any other sources of income.

03

Enter the cost of goods sold (COGS) or cost of services provided, which includes the direct costs associated with producing goods or delivering services.

04

Add any operating expenses, such as rent, utilities, salaries, and advertising costs.

05

Subtract the total expenses from the revenue to calculate the net profit or loss.

06

Review the profit and loss worksheet to ensure accuracy and make any necessary adjustments.

07

Use the information from the profit and loss worksheet to analyze the financial performance of the business and make strategic decisions.

In order to simplify the process of completing profit and loss worksheets, users can leverage the power of pdfFiller. pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently complete their profit and loss worksheets.