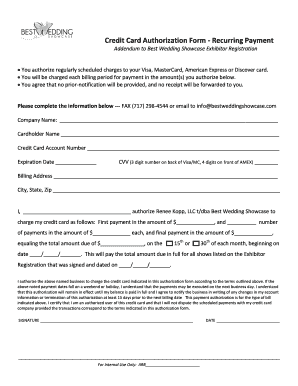

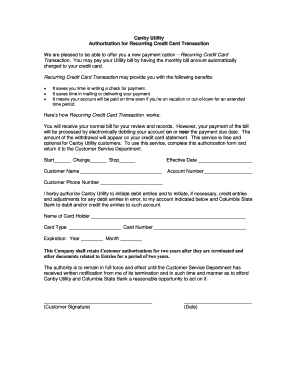

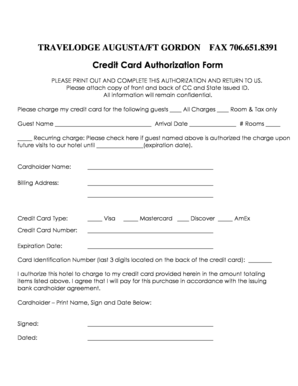

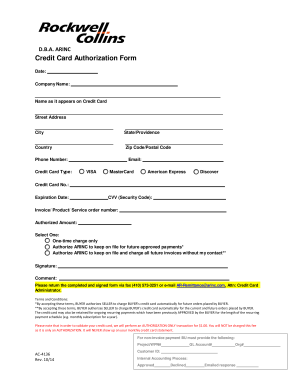

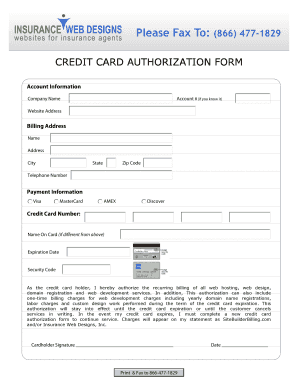

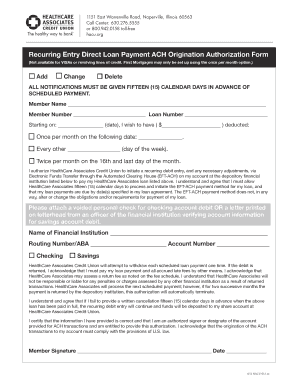

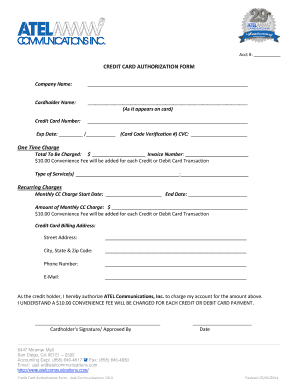

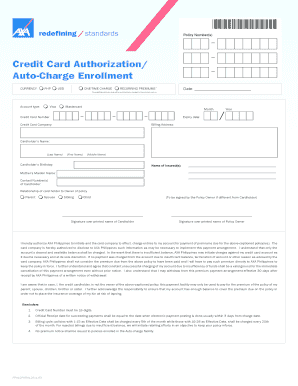

What is a recurring credit card authorization form?

A recurring credit card authorization form is a document that allows a merchant or service provider to charge a customer's credit card on a regular basis, typically for recurring payments or subscriptions. By obtaining the customer's permission and credit card information, the merchant can automatically charge the customer's card without requiring manual authorization for each transaction.

What are the types of recurring credit card authorization forms?

There are several types of recurring credit card authorization forms, including:

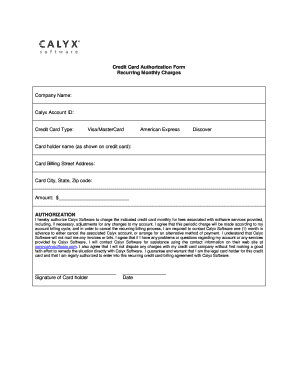

Fixed recurring payment: This type of form is used when the amount being charged remains the same for each payment. It is commonly used for membership fees, monthly subscriptions, or other recurring expenses with a consistent cost.

Variable recurring payment: This form is used when the amount being charged may vary for each payment. It is often used for utility bills, credit card bills, or services where the charges can fluctuate.

Installment recurring payment: This form is used when a larger expense is split into multiple payments. It is often used for installment plans, financing options, or larger purchases that customers prefer to pay off over time.

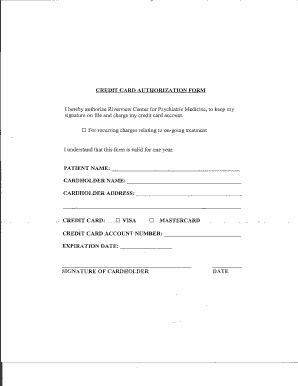

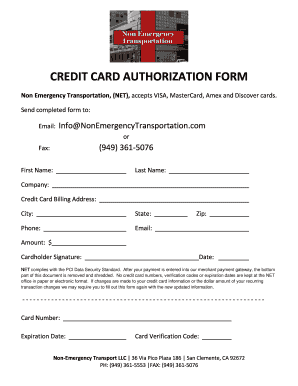

How to complete a recurring credit card authorization form

Completing a recurring credit card authorization form is a straightforward process. Here are the steps:

01

Provide your personal information: Fill in your name, address, email, and phone number. This information helps identify you as the cardholder.

02

Enter your credit card details: Provide your credit card number, expiration date, and CVV code. This information is crucial for the merchant to charge your card securely.

03

Specify the payment frequency: Indicate whether the payments will be weekly, monthly, quarterly, or on a different schedule.

04

Authorize the recurring payments: Sign and date the form to give your consent for the merchant to charge your credit card for the specified amount and frequency.

05

Keep a copy for your records: Make sure to keep a copy of the completed form for your reference and future communication with the merchant.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.