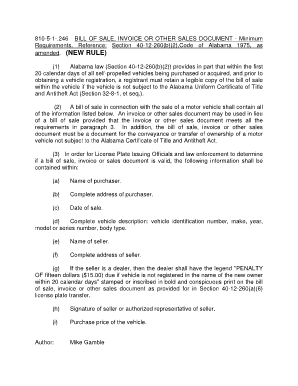

What is Sales Invoice?

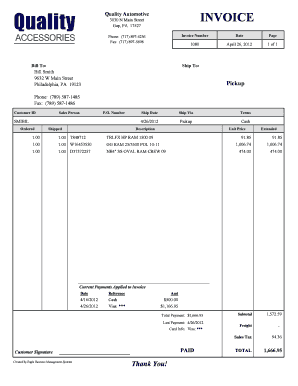

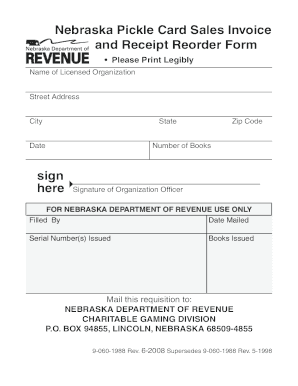

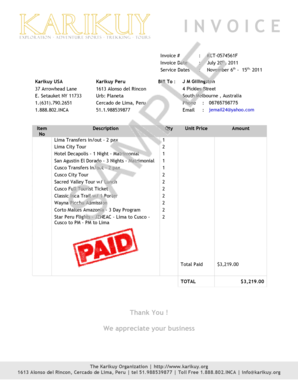

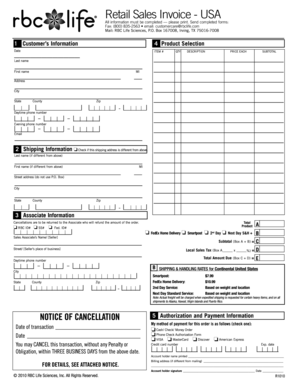

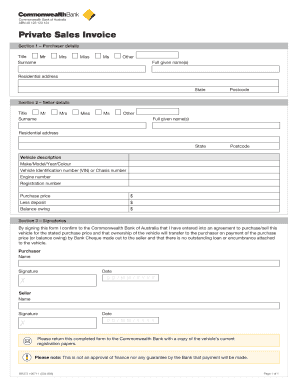

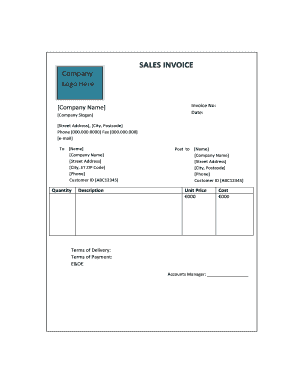

A sales invoice is a document that provides a detailed breakdown of a transaction between a seller and a buyer. It is usually issued by the seller to the buyer and contains information such as the quantity and description of the goods or services sold, the price, payment terms, and any applicable taxes or discounts. The sales invoice serves as proof of the transaction and is commonly used for record-keeping and accounting purposes.

What are the types of Sales Invoice?

There are various types of sales invoices depending on the nature of the transaction and the industry involved. Some common types of sales invoices include:

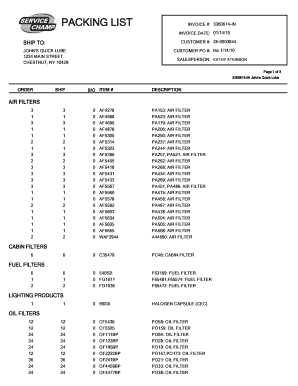

Standard Invoice: This is the most basic type of sales invoice and is used for a one-time sale of goods or services.

Recurring Invoice: This type of sales invoice is used for recurring transactions where the same goods or services are provided at regular intervals.

Proforma Invoice: A proforma invoice is used to provide the buyer with an estimate of the cost of the goods or services before the actual transaction takes place.

Credit Invoice: A credit invoice is issued when there is a need to adjust or refund the amount owed by the buyer due to returns, discounts, or other reasons.

Debit Invoice: This type of sales invoice is used to adjust or add additional charges to the amount owed by the buyer, such as late payment fees or additional services.

Electronic Invoice: Also known as e-invoice, this type of sales invoice is generated and transmitted electronically, eliminating the need for paper-based documents.

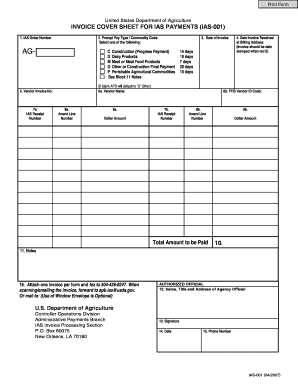

How to complete Sales Invoice

Completing a sales invoice is a straightforward process that can be done with ease. Here are the steps to follow:

01

Start by entering your company's information, including name, address, and contact details, at the top of the invoice.

02

Next, fill in the buyer's information, including name, address, and contact details.

03

Specify the invoice number, issuance date, and due date.

04

Provide a description of the goods or services sold, including their quantity, unit price, and any applicable taxes or discounts.

05

Calculate the subtotal, including any taxes or discounts.

06

Include any additional charges, such as shipping fees or late payment penalties, if applicable.

07

Finally, calculate the total amount due and clearly state the payment terms, including accepted payment methods and any applicable late payment fees.

08

Review the completed sales invoice for accuracy and make any necessary adjustments before sending it to the buyer.

With pdfFiller, completing sales invoices is made even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.