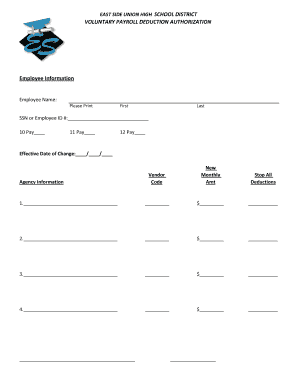

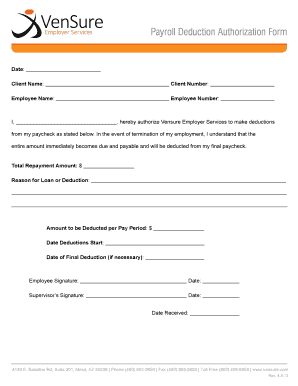

Sample Authorization For Voluntary Payroll Deduction Form

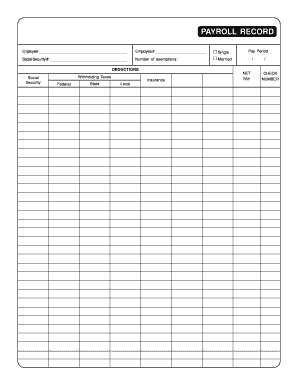

What Is the Voluntary Payroll Template?

The voluntary payroll procedure takes place when an employee wants to purchase some insurance plan on top of the standard one and pay money for it from his/her paycheck. It is very useful as in the case of transferring to a new company. It's all because the company pays nothing for this person's plan, but only deducts the needed sum from the salary automatically. Those payments may be used to cover Social Security and Medicare taxes, unemployment insurance or disability insurance (if it is applicable according to the tax laws of the state you live in).

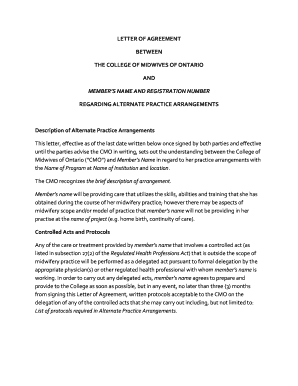

In those cases, the voluntary payroll authorization template is filed. It helps you authorize the organization you want to provide monthly payments to. It is necessary to complete the document before you start making payments to avoid further misunderstandings. Setting regular payment withdrawal helps to avoid forgetting to pay, thus you will owe nothing because the needed sum will be scheduled for automatic withdraw. Those payments are not required by tax payment laws, but they are still popular among taxpayers.

How to Complete the Voluntary Payroll Sample

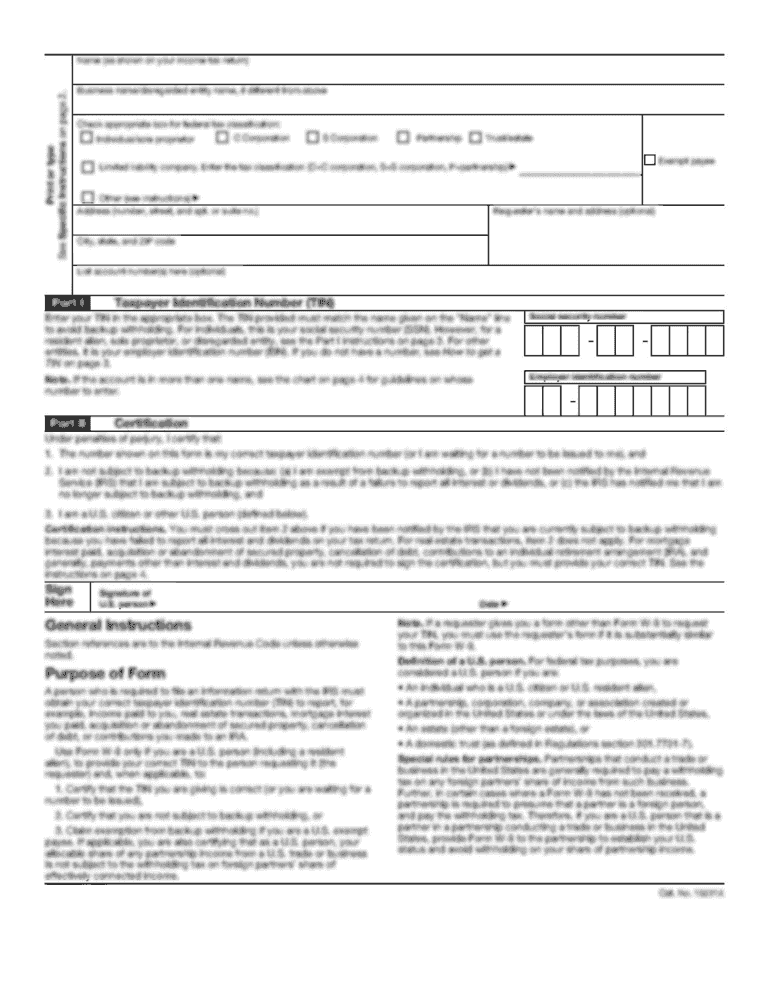

Find the applicable form variant in the internal PDFfiller library. Open the sample and read the instructions to the form. If it has no highlighted areas, use the text tool to fill out the sample or add fillable fields manually. The document includes the following information:

Save the template and share it the way you prefer: either file digitally by e-mail or print it on a sheet of paper.