Sample Loan Agreement Between Family Members

What is a sample loan agreement between family members?

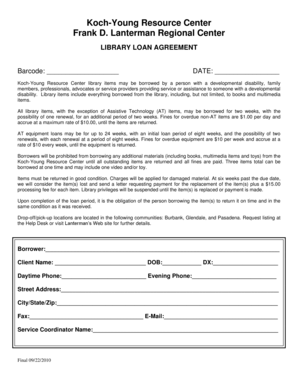

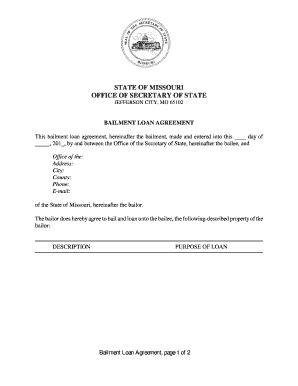

A sample loan agreement between family members is a legally binding document that outlines the terms and conditions of a loan transaction between relatives. This agreement helps to ensure that both parties are protected and understand their responsibilities and obligations.

What are the types of sample loan agreement between family members?

There are several types of sample loan agreements between family members, including: 1. Promissory Note: A simple agreement that states the borrower's promise to repay the loan. 2. Installment Agreement: An agreement that outlines a schedule for repayment in regular installments. 3. Balloon Payment Agreement: A loan agreement that requires the borrower to make a large payment at the end of the term. 4. Secured Loan Agreement: A loan agreement that uses collateral to secure the loan. 5. Unsecured Loan Agreement: A loan agreement that does not require collateral.

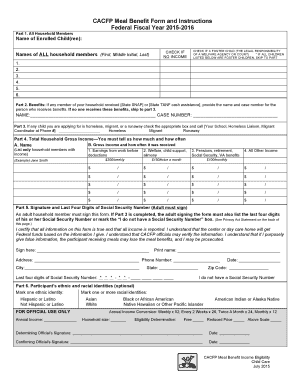

How to complete a sample loan agreement between family members

Completing a sample loan agreement between family members is a straightforward process. Here are the steps you can follow: 1. Gather the necessary information: Collect all the details about the loan, including the loan amount, interest rate, repayment terms, and any additional conditions you want to include. 2. Draft the agreement: Use a template or create your own loan agreement document. Include all the relevant information and make sure both parties agree on the terms. 3. Review and edit: Carefully review the agreement for any errors or inconsistencies. Make necessary edits to ensure accuracy. 4. Sign the agreement: Both the lender and the borrower should sign the loan agreement to make it legally binding. 5. Keep a copy: Make sure to keep a copy of the signed loan agreement for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.