Sample Mortgage Hardship Letter - Page 2

What is a Sample Mortgage Hardship Letter?

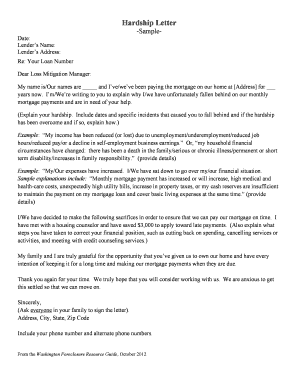

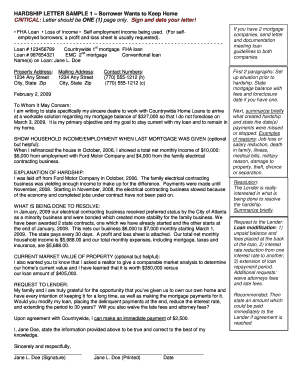

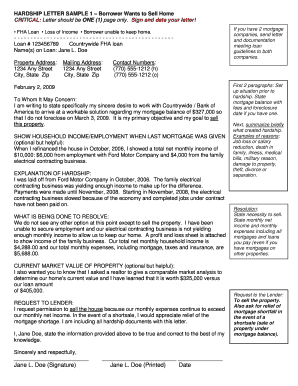

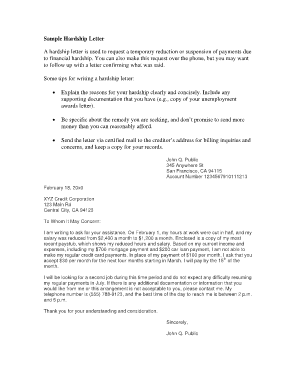

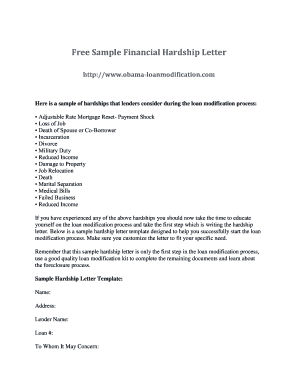

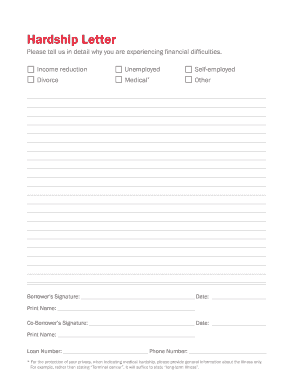

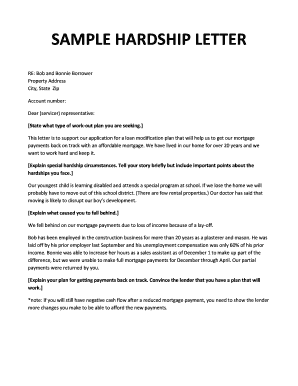

A Sample Mortgage Hardship Letter is a formal written document that homeowners submit to their mortgage lender when they are experiencing financial difficulties and are unable to make their mortgage payments. It explains the homeowner's current financial situation, the reasons for the hardship, and includes a request for assistance or a modification of their mortgage terms.

What are the types of Sample Mortgage Hardship Letter?

There are several types of Sample Mortgage Hardship Letters that homeowners can use based on their specific situation. Some common types include:

How to complete a Sample Mortgage Hardship Letter

Completing a Sample Mortgage Hardship Letter requires careful thought and attention to detail. Here is a step-by-step guide to help you:

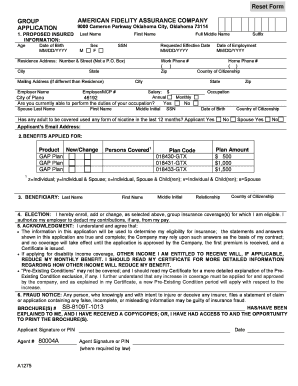

If you need assistance in creating or editing your Sample Mortgage Hardship Letter, pdfFiller is a valuable tool that can help. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to create, edit, and share documents online. It is the only PDF editor you need to get your documents done efficiently and effectively.