Satisfaction Of Mortgage Example

What is satisfaction of mortgage example?

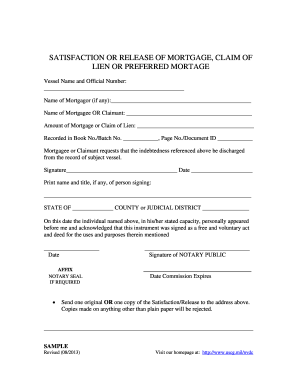

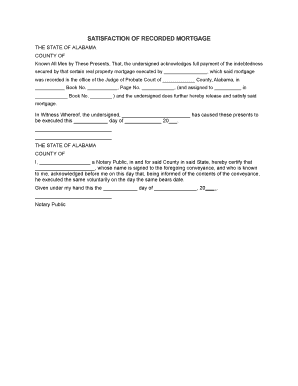

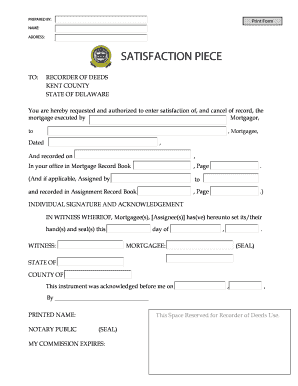

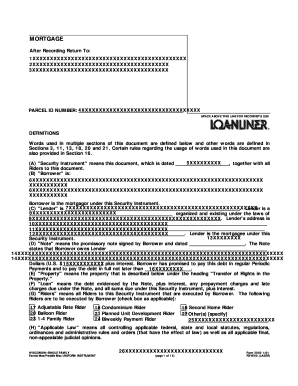

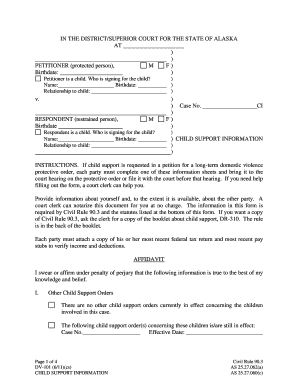

Satisfaction of mortgage example refers to the process of proving that a mortgage loan has been fully paid off and releasing the mortgage lien from the property. When a borrower pays off their mortgage in full, they receive a satisfaction of mortgage document as proof of the loan's satisfaction.

What are the types of satisfaction of mortgage example?

There are two common types of satisfaction of mortgage examples: 1. Full Satisfaction: This occurs when the borrower pays off the entire mortgage loan amount, including the principal and any accrued interest. Once the full payment is made, the lender provides a satisfaction of mortgage document. 2. Partial Satisfaction: This happens when the borrower pays off a portion of the mortgage loan, reducing the overall balance. In such cases, the lender issues a partial satisfaction of mortgage document to acknowledge the partial payment and adjust the remaining balance accordingly.

How to complete satisfaction of mortgage example

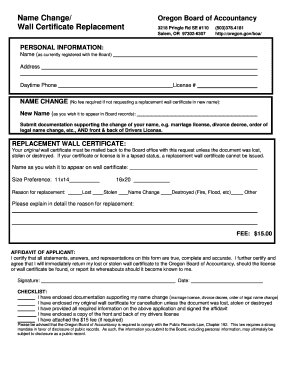

Completing a satisfaction of mortgage example involves several steps to ensure that the process is carried out correctly. Here are the steps to follow: 1. Obtain a satisfaction of mortgage form: You can download the form from your lender or any trusted legal source. 2. Fill in the required information: Provide the necessary details, such as the borrower's name, property address, mortgage loan number, and the amount paid. 3. Attach supporting documents: If required, attach any supporting documents, such as the payoff statement and proof of payment. 4. Sign and date the form: Both the borrower and the lender should sign and date the satisfaction of mortgage document. 5. Submit the form: Send the completed form to your lender or the appropriate authority to officially record the loan's satisfaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.