Sba Personal Financial Statement

What is sba personal financial statement?

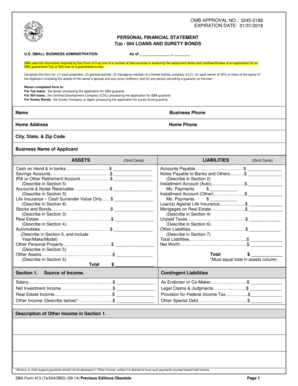

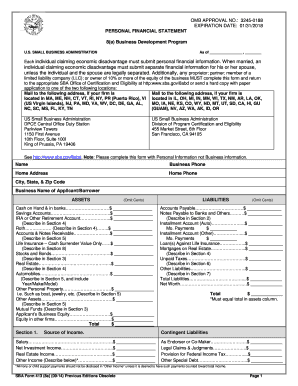

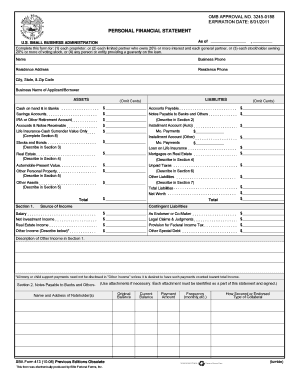

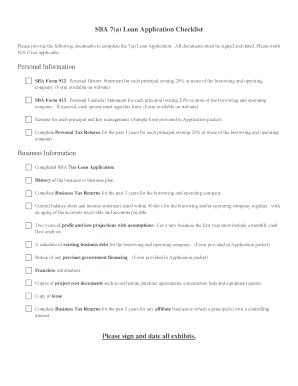

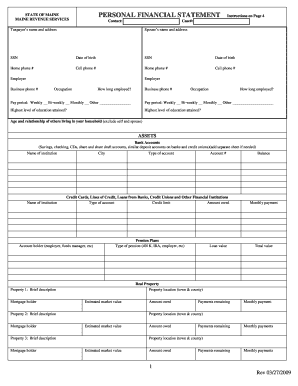

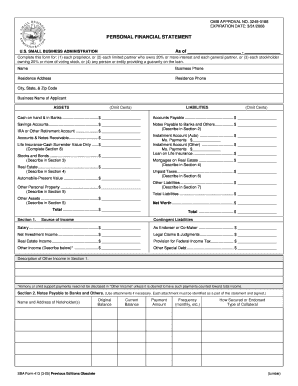

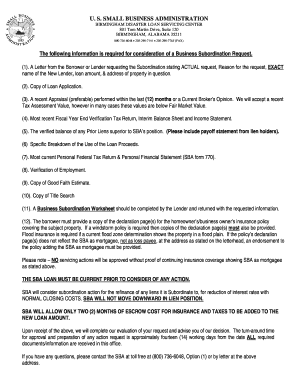

A SBA personal financial statement is a document that summarizes an individual's financial situation. It provides an overview of assets, liabilities, income, and expenses. This statement is often required by the Small Business Administration (SBA) when applying for loans or other financial assistance.

What are the types of sba personal financial statement?

There are two main types of SBA personal financial statements:

Personal Balance Sheet: This type of statement provides a snapshot of an individual's financial position at a specific point in time. It includes assets, liabilities, and net worth.

Personal Income Statement: This type of statement provides information about an individual's income and expenses over a specific period of time, such as a month or a year.

How to complete sba personal financial statement

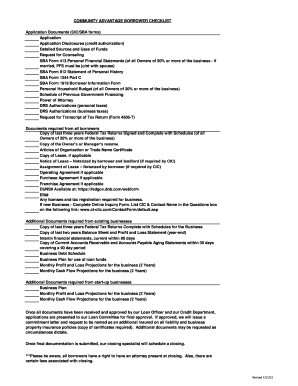

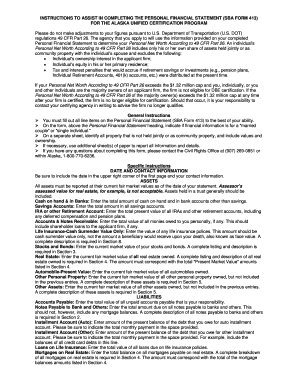

Completing an SBA personal financial statement is an important step in the loan application process. Here are some tips to help you complete it accurately:

01

Gather all your financial documents, including bank statements, tax returns, and investment statements.

02

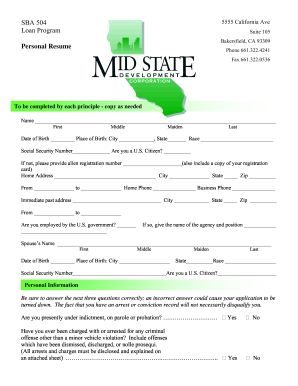

Enter your personal information, including your name, address, and Social Security number.

03

List all your assets, such as cash, investments, real estate, and personal property.

04

Detail all your liabilities, such as loans, credit card debts, and mortgages.

05

Calculate your net worth by subtracting your total liabilities from your total assets.

06

Provide information about your income, including salary, bonuses, rental income, and investments.

07

Itemize your monthly expenses, such as housing costs, transportation, utilities, and insurance.

08

Double-check all the numbers and ensure the statement is accurate and up-to-date.

09

Sign and date the statement before submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a personal financial statement?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

What should I put on my SBA form 2202?

What Is Sba Form 2202?All long-term and short-term liabilities - such as accounts payable, notes payable, accrued payroll, and mortgage payments - should be described. First, the applicant has to provide their name and the date when the schedule is prepared. The first column requires the name of each creditor.

How do I fill out a personal financial statement with SBA?

How to fill out SBA Form 413 Step 1: Fill in basic business information. Step 2: Add information about your assets. Step 3: Add information about your liabilities. Step 4: Complete section 1 for your source of income and contingent liabilities. Step 5: Complete section 2 with your notes payable to banks and others.

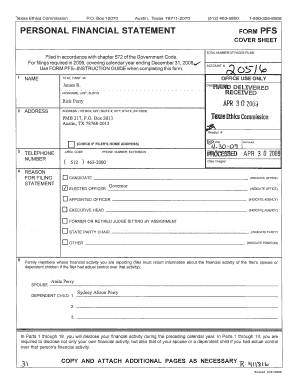

What is a PFS template?

It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.

What two things should be on a personal financial statement?

Key Takeaways. A personal financial statement lists all assets and liabilities of an individual or couple. An individual's net worth is determined by subtracting their liabilities from their assets—a positive net worth shows more assets than liabilities.

What items should be identified on a personal financial statement?

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.