Simple Loan Application Form Template

What is simple loan application form template?

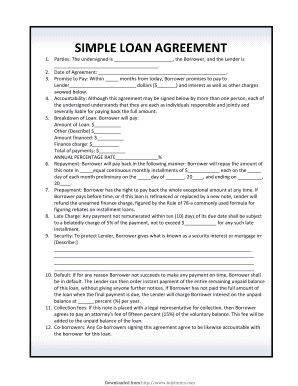

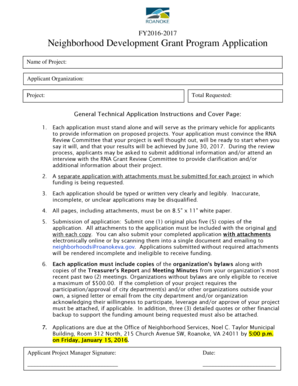

A simple loan application form template is a pre-designed document that helps individuals or businesses apply for loans easily and efficiently. This template provides a structured format where applicants can input their personal and financial information, along with any supporting documents required by the lender. By using a simple loan application form template, applicants can streamline the loan application process and ensure that all the necessary details are included.

What are the types of simple loan application form template?

There are various types of simple loan application form templates available to cater to different lending scenarios and requirements. Some common types include: 1. Personal Loan Application Form: Used for individuals applying for personal loans to meet their financial needs. 2. Business Loan Application Form: Specifically designed for businesses seeking funding for expansion, working capital, or other purposes. 3. Mortgage Loan Application Form: Used by individuals or businesses applying for a loan to finance the purchase of a property. 4. Auto Loan Application Form: Designed for individuals looking to finance the purchase of a vehicle. 5. Student Loan Application Form: Used by students applying for educational loans to fund their studies.

How to complete simple loan application form template

Completing a simple loan application form template is a straightforward process. Here are the steps to follow: 1. Start by filling in your personal details, such as your name, contact information, and social security number. 2. Provide information about your employment, including your current employer, job title, and monthly income. 3. Fill in details about the loan you are applying for, such as the desired loan amount, purpose of the loan, and repayment terms. 4. If required, attach supporting documents such as income proof, bank statements, or identification documents. 5. Review the completed form carefully to ensure all the information is accurate and complete. 6. Sign and submit the form along with any required documents to the lender. By following these steps, you can efficiently complete a simple loan application form template and increase your chances of approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.