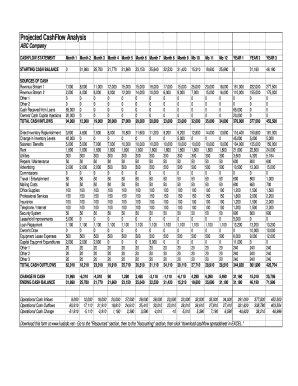

What is Small Business Cash Flow Projection?

Small Business Cash Flow Projection is a financial management tool that helps businesses estimate their future cash inflows and outflows. It allows business owners to predict how much money will be coming into the business and how much will be going out over a specific period of time. Cash flow projections are important for small businesses to ensure that they have enough funds to cover their expenses and make strategic decisions about investing in growth opportunities.

What are the types of Small Business Cash Flow Projection?

There are several types of Small Business Cash Flow Projection that businesses can use depending on their needs and goals. These include:

Direct Method: This method involves tracking each cash inflow and outflow separately to determine the overall cash position.

Indirect Method: This method starts with net income and adjusts it for non-cash transactions and changes in working capital to calculate the net cash flow.

12-Month Cash Flow Projection: This type of projection provides a comprehensive view of the business's cash flow for the upcoming year.

Weekly or Monthly Cash Flow Projection: This type of projection focuses on shorter-term cash flow forecasting to help businesses manage their day-to-day expenses and cash flow more effectively.

How to complete Small Business Cash Flow Projection

Completing a Small Business Cash Flow Projection requires careful analysis and forecasting. Here are the steps to follow:

01

Gather all relevant financial data, including past income statements, balance sheets, and cash flow statements.

02

Identify your sources of cash inflows, such as sales revenue, loans, and investments.

03

Determine your cash outflows, including expenses, loan repayments, and taxes.

04

Take into account any seasonal or cyclical trends that may impact your cash flow.

05

Calculate your projected cash flow by subtracting your cash outflows from your cash inflows.

06

Review and analyze your cash flow projection regularly to make necessary adjustments and optimize your cash flow management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.