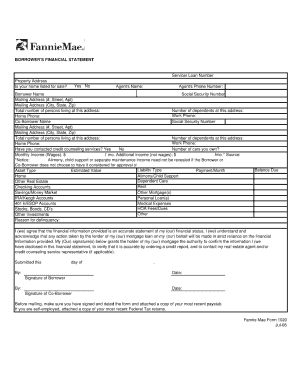

Small Business Financial Statement Form

What is small business financial statement form?

A small business financial statement form is a document that records the financial activities and performance of a small business. It provides a comprehensive overview of the company's financial position, including its assets, liabilities, revenue, and expenses. The form is typically used by small business owners, stakeholders, and financial institutions to assess the company's financial health and make informed decisions.

What are the types of small business financial statement form?

There are several types of small business financial statement forms, each serving a specific purpose. Some common types include: 1. Income Statement: Also known as a profit and loss statement, it shows the company's revenues, expenses, and net income over a specific period. 2. Balance Sheet: It provides a snapshot of the company's assets, liabilities, and shareholders' equity at a specific point in time. 3. Cash Flow Statement: This statement tracks the inflow and outflow of cash within the business, helping to understand its liquidity and cash management. 4. Statement of Retained Earnings: It details the changes in a company's retained earnings over a specific period, reflecting net income, dividends, and other adjustments.

How to complete small business financial statement form

Completing a small business financial statement form can seem daunting, but with the right approach, it becomes manageable. Here are the steps to follow:

With pdfFiller, completing small business financial statement forms becomes even easier. Its user-friendly interface and powerful editing tools allow you to create, edit, and share financial statements online. Whether you need to fill out an income statement, balance sheet, or any other financial form, pdfFiller has unlimited fillable templates to meet your needs.